Disability Insurance for Business Owners

Jan 02, 2017

If your business depends on your ability to actively generate income, your absence due to disability can have a significant impact on your financial well-being.

If your business depends on your ability to actively generate income, your absence due to disability can have a significant impact on your financial well-being.

Business owners can layer two disability insurance coverages to provide protection for both short and long-term insurance needs.

Disability Insurance 101

A disability insurance policy replaces a portion of your income by providing a monthly benefit amount if sickness or injury prevents you from working.

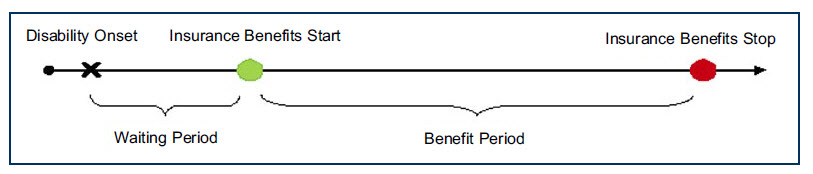

Waiting & Benefit Period

The “Elimination Period” (aka Waiting Period) is the amount of time that must elapse from the onset of a disability before you are entitled to receive monthly benefits. The “Benefit period” refers to how long you will receive payments.

The longer the waiting period, the lower the premium. The waiting period can be adjusted based on your liquidity position – the savings or capital reserves you maintain.

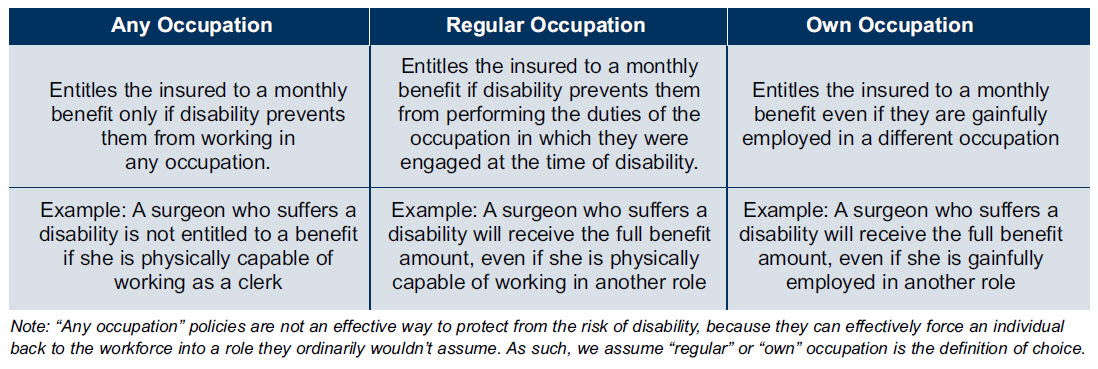

Definition of Occupation

How occupation is defined in a policy determines if you are eligible to receive benefits when sickness or injury prevents you from working. (All definitions in this article assume you are under the appropriate care and attendance of a physician.)

Short Term:

Business Overhead Insurance

Loss of revenues due to a sidelined owner can result in reduced profits and additional resources are required in the short term to hire and train replacements while continuing income to the disabled partner. If the backup plan is to sell the business, having short-term financial flexibility can buy the time necessary to find a suitable deal at a fair price (as opposed to selling at a discount due to distress).

Business Overhead insurance covers eligible business overhead expenses in case of disability of an owner/partner who actively generates income for the company. Eligible expenses include salaries, rent, other operating expenses, and utilities.

Benefit payments start after an initial waiting period of typically 30 - 90 days and the payment period is usually 12, 18 or 24 months.

The premiums are a tax-deductible business expense, making the disability benefit taxable (since overhead expenses themselves are tax-deductible, the tax effect is neutral).

An additional policy feature to consider is the rider to increase coverage in the future as expenses rise over time, without the requirement of additional medical underwriting at each increase.

Long-Term:

Personal Disability Insurance

Long-term security for the business owner and family represents a re- placement of the net cash flow that would have otherwise been earned in the absence of disability – the long-term income the family relies on to meet their desired standard of living and future expenses.

A personal disability insurance policy serves this purpose, as the benefit period is longer in nature - typically to age 65.

A business owner with overhead coverage in place can extend the waiting period of the personal policy to 365 or 720 days, significantly reducing the cost of the long-term personal coverage.

Common riders to add include the Cost-of-Living Adjustment or indexation of benefits to account for rising costs. The Additional Insurance Rider gives you the option to increase coverage

in the future (for an additional cost) without requiring medical underwriting at each increase.

Comprehensive Pairing

In the short term, business value is protected by the overhead coverage and in the long-term, the financial security of the business owner (and family) is too.

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More