First Home Savings Accounts – Available Soon

Jul 04, 2023

Buying a home can be a challenge for many Canadians. Fluctuations in home prices, along with increased interest costs play a huge part in a first-time homebuyer’s ability to afford a home. The new Tax-Free First Home Savings Account (FHSA) aims to make this a little easier by offering Canadians a way to save for a down payment on their first home.

What are the benefits of opening a First Home Savings Account (FHSA)?

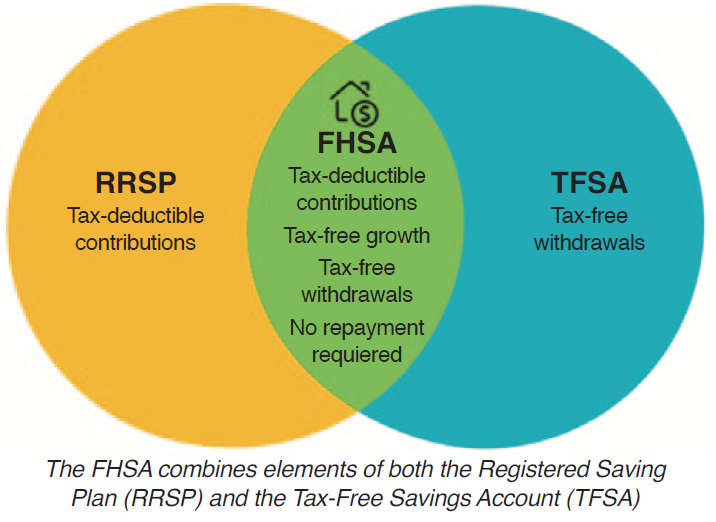

The FHSA is a hybrid between a Registered Retirement Savings Plan (RRSP) and a Tax-Free Savings Account (TFSA). Like an RRSP, contributions to the FHSA are tax- deductible and the tax deduction can either be used in the year that you make your contribution or can be carried forward to be used in the future when the deduction might be more useful. Any growth or income within the FHSA is tax free (like a TFSA) if the proceeds are used to purchase a qualifying home.

Planning Opportunity: What if I don’t end up buying a qualifying home?

If you qualify for an FHSA, but either don’t plan on purchasing a home, or are unsure of whether you might buy a home in Canada, you should still consider opening up an FHSA. This would provide you with a tax deduction over and above any deductions that you have, and tax-free growth while the proceeds remain in the plan. If you don’t end up purchasing a qualifying home, the FHSA proceeds can be transferred tax-free to RRSP without impacting your RRSP contribution room. Future withdrawals from your RRSP or Registered Retirement Income Fund (RRIF) would be taxable but could be spread out over time.

How does the FHSA compare to other ways of saving for a home like a TFSA or RRSP?

The tax advantages offered by the FHSA can make it the most tax-efficient of all the registered accounts available in Canada, but using the RRSP Home Buyers’ Plan and TFSA can also bring advantages. You have the option of using all three. The route that you choose would depend on your personal situation.

Who can open a FHSA?

To open an FHSA, an individual must be:

c) Someone who has not owned a home in the past four calendar years

An FHSA must be closed at the earlier of:

c) The year the account holder turns 71

Speak with your RGF Integrated Wealth Management advisor to confirm if opening an FHSA fits with your overall financial plan.

Estate Planning Misconceptions

In this 5-minute webinar, we explore an important but often misunderstood area of financial planning.

Learn More