Human Capital and the Financial Life Cycle

Jan 01, 2016

Take a moment to think back to the day you got your first job. At that time, you likely had minimal financial assets and no real estate. However, this apparent lack of wealth concealed that you possessed plenty of a different type of valuable asset: human capital.

Take a moment to think back to the day you got your first job. At that time, you likely had minimal financial assets and no real estate. However, this apparent lack of wealth concealed that you possessed plenty of a different type of valuable asset: human capital.Human capital, in the financial planning sense of the term, relates to your potential to generate an income. The financial life cycle, which represents the three major money phases that you go through in your adult life – accumulation, retirement and estate, is closely linked to the transition of human capital. This article explains how we transform our human capital into cash flow to acquire lifestyle assets, build financial security and transition wealth to the next generation.

Defining Human Capital

Human capital is the present value of all your projected future earnings. It is highest when you are young and diminishes over your working career. If you are between the ages of 20 and 40, it is likely your most valuable asset.Human capital represents the collection of skills, education, knowledge and experience that allows each of us to produce economic value and generate an income. It can be created by investing time and money into building a specific skill set or profession providing you with the opportunity to command a higher wage or price for your services. Famed investor Warren Buffett once said that “the best investment you can make is always in yourself”.

Accumulation Phase - Transforming Human Capital to Financial Assets

This is the period of time when your spending needs are covered by the income you generate from your work or human capital. The excess is used to acquire lifestyle assets and to build financial assets for the future. Ranging from 40-50 years in length, the accumulation phase is the longest portion of the financial life cycle and contains three distinct sub-phases:Early Accumulation Phase

In the early part of your career, the majority of your income will be directed to lifestyle or personal use assets, such as your home, furniture, clothing and car. You are full of potential and your human capital is high, but your financial net worth and financial flexibility might be low or negative due to student loans, consumer debt or a mortgage.

Mid Accumulation Phase

As you progress through the accumulation phase, your earnings rise and the pace at which your human capital is transformed through your work increases. This allows you to build financial assets, such as pensions and RRSPs for retirement, education funds for your children and TFSAs for contingencies or major future expenditures.

Late Accumulation Phase

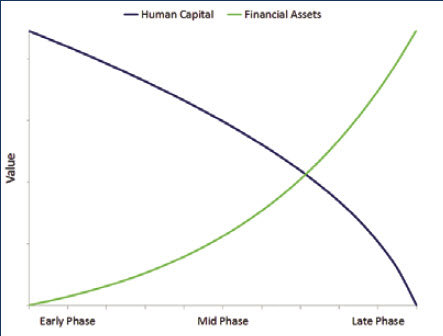

As you approach the end of the accumulation phase, your annual earnings are at their highest but your human capital is falling quickly. Conversely, your financial assets and your financial flexibility are increasing and are typically at the highest level as you end your career.Most of us experience the following relationship between our human capital and financial assets during the accumulation phase:

Retirement Phase - Transforming Financial Assets to Cash Flow

Also known as the income phase, this is the time of life when you transition to using your savings to fund cash flows in order to meet spending needs.Retirement is the stage at which your human capital is at or near zero and the transformation from human capital to financial assets, real estate and personal use assets is complete. During this stage, RRSPs are transitioned to RRIFs, pensions may be converted to a income and businesses or real estate are often sold and invested to generate cash flows.

Although you may have the ability to generate an income, may prefer, instead, to travel and pursue other interests than continue to work. Ideally, you will have this level of financial flexibility during retirement.

Estate Phase - The Final Transformation

This is the final phase when your remaining financial, personal use and real estate assets are transitioned to your children, other family members or charities. These gifted assets form part of the legacy you leave behind. Your estate is the last opportunity you have to effect a transition of the capital you created in your lifetime or inherited from previous generations.Protecting Human Capital

Human capital is an asset that should be protected using life and disability insurance, especially in the early to midcareer years when your human capital is high and your financial and real assets are low. In the late stages of your career, when your financial and real assets are high, the need for insurance to protect your human capital diminishes.Many of us focus on the value of our savings, investments, pensions and real estate when considering our net worth. However, far fewer of us also consider the immense value of our remaining human capital in this calculation. While the road we follow is unique to each of us, there are similarities in both how we employ our human capital and how we allocate the proceeds of our work over the course of our financial life cycle.

Why do we plan?

Knowing where you are translates into knowing where you’re going, and we hope to provide every client with the trust and confidence to navigate through the waters of their financial lives.

Learn More