Maintaining your Retirement Capital

Oct 02, 2017

Everyone has different goals and expectations for their retirement. Likewise, everyone has a different level of financial resources they can use to achieve these goals. Each of us also possesses a specific tolerance for taking risk with these resources. As financial advisors, part of our job is to craft a plan for each of our clients that incorporates each of these variables. While each plan, like each person, is unique, the math that supports retirement income planning is consistent regardless of one’s goals, resources or risk tolerance. Keeping retirement savings in cash might be considered by some to be a low-risk option. Indeed, this strategy eliminates the risk of experiencing declines in the stock market. However, in an era where people are living longer than ever before, it also increases the risk of outliving one’s savings.

Everyone has different goals and expectations for their retirement. Likewise, everyone has a different level of financial resources they can use to achieve these goals. Each of us also possesses a specific tolerance for taking risk with these resources. As financial advisors, part of our job is to craft a plan for each of our clients that incorporates each of these variables. While each plan, like each person, is unique, the math that supports retirement income planning is consistent regardless of one’s goals, resources or risk tolerance. Keeping retirement savings in cash might be considered by some to be a low-risk option. Indeed, this strategy eliminates the risk of experiencing declines in the stock market. However, in an era where people are living longer than ever before, it also increases the risk of outliving one’s savings. Balancing these two risks (temporary investment losses vs. outliving one’s nest egg) is a critical part of any retirement income planning strategy. Surprisingly, one doesn’t need to take on significant stock market risk to meaningfully increase the expected lifespan of his or her retirement savings.

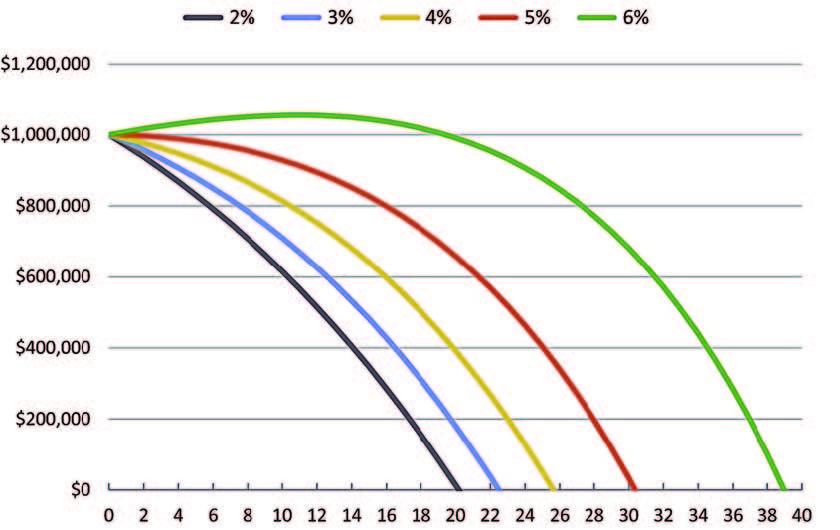

To illustrate this point, the following provides a convincing argument that tolerating some risk with your retirement capital is likely safer than accepting no risk at all. Imagine a $1 million retirement portfolio that pays out $50,000 annually (increasing at 2% per year to keep up with inflation). The values of this hypothetical portfolio over a 20+ year period using various rates of return are illustrated below.

How Long Will This Million Dollar Retirement Portfolio Last?

Grey Line – If the portfolio merely generates a return equal to the rate of inflation (2% in this example), the capital would last exactly 20 years. This level of investment return should be expected by someone who does not want to take any risk whatsoever within his or her retirement portfolio.

Blue Line – Someone willing to take on slightly more risk (perhaps investing a portion of the funds in bonds) who achieves a return 1% higher than the rate of inflation can expect this capital to last approximately two additional years.

Yellow Line – A 4% rate of return would allow the retirement capital to last nearly 26 years.

Orange Line – This is the point at which slightly higher returns begin to make a significant difference. A 5% annual rate of return, which would likely require at least a modest allocation to stocks, extends the life of this capital to 30 years (a full 50% more than in the first scenario).

Green Line – An extra 1% of annual returns might not seem noteworthy, but over multiple decades it can create substantial results through the power of compounding. A portfolio that is able to generate a 6% rate of return would provide nearly 40 years of withdrawals.

Given the current low interest rate environment, generating returns of 4-6% per year likely requires at least a partial allocation to riskier assets (such as stocks). The resulting investment portfolios will experience greater fluctuations in value than the ones that produce the grey and blue lines in the above chart. However, the reward for living with this additional volatility is a meaningful increase in the number of years of income that can be generated in retirement. Furthermore, we utilize strategies to help clients manage this volatility.

The power of compounding works as your friend while your investments are growing over time, but the compounding effects of inflation can reduce your spending power during retirement. With an annual inflation rate of only 2%, over 20 years each dollar loses more than 30% of its purchasing power. An investment portfolio that earns a rate of return higher than inflation will increase its purchasing power and last substantially longer in retirement than a portfolio comprised entirely of GICs or bank savings.

Ultimately, determining the proper strategy for a retirement plan is about balancing and managing various risks. Monitoring the performance of the plan and maintaining the right balance is one the primary roles we perform as professional advisors to help our clients live comfortably in retirement.

You might also be interested in...

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.