Making the Best Use of Your Home Equity in Retirement

Oct 20, 2018

In the past 10+ years, Vancouver homeowners have enjoyed significant increases in property values. In some cases, property values have increased 2x and 3x depending on when the property was purchased, thereby creating significant equity that can be utilized at some point. Baby boomers who are nearing retirement often wonder how to make the best use of it.

Perhaps it’s after the kids have moved out, a desire for more retirement income (i.e. to travel more or pay down debt), or maybe it’s a recent health concern making walking up and down the stairs a challenge. Whatever the reason, making the right choice is no doubt one of the biggest decisions that a homeowner will face, especially considering the lasting effect for years to come.

Before making any big choices, I cannot stress enough the importance of having a team on your side who understands your past and present financial position, in addition to your goals… I like to call this your “Inner Circle”. Just as your financial advisor is an integral part of your team, your accountant will help you ensure your plans are tax-efficient, your banker will assist with your individual borrowing needs, your lawyer will keep you safe, and your realtor will advise you on matters related to real estate. These professionals, or your inner circle, offer important advice that cannot be underscored enough.

Making the best use of built-up equity

Downsizing is a popular way to make good use of the equity in your home, but you must make sure it’s worth it! Some of the uses of the remaining equity might include:

In my experience, wealth distribution is a key consideration with baby boomers nearing retirement. They want to make sure their children get best use of the equity built up from the family home. This equity is often used as an “early inheritance” that goes toward the children’s down payment toward their first home. Your lawyer will be a key advisor on this matter.

Retirement income

Your financial advisor can help turn home equity into increased income in retirement. Depending on your situation, the increase in cash flow could be considerable. Your financial advisor will be a key asset in this conversation as preservation of these funds will likely be a key.

Travel

Who doesn’t want to travel more? The remaining equity and/ or increased cash flow can certainly help get you travelling more.

Finding an ideal new home

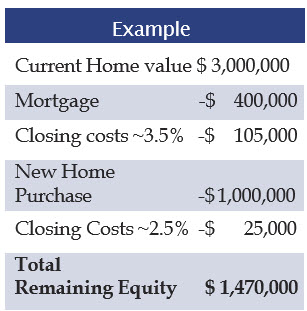

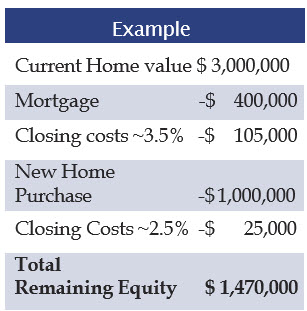

If you’ve made the decision to start exploring the idea of moving to a different, less expensive (and perhaps smaller) home, your realtor will start with a market evaluation of your home and identify its potential selling price in its current condition and market. To find this out, subtract any outstanding mortgages and closing costs, and the cost of your new property. Your realtor can help you work out your own individual numbers.

You will also want to consider the type of property you might want to move to. Is it a smaller single- level home, or perhaps a condominium? And what about the area? You’ll want to think about being close to healthcare, grocery stores, public transportation etc. Also, do you want an indoor pool and fitness facility?

![]()

You will find that moving to a less expensive area will help you obtain a larger space, while keeping more of the equity from the sale of the property.

Other Considerations

Watch out for monthly strata fees, taxes, and small repairs that you might want to complete prior to, or shortly after, moving in.

Project Home

For those who are willing to take on a project, they might also consider a property that needs a renovation. Properties that are in “original” condition offer an opportunity to renovate to the buyer’s exact liking, thereby making it their own, and usually, for less money than what the property would have sold for in its renovated state.

Bottom line: The equity in your home can be a powerful retirement planning tool. Stay in touch with your Inner Circle to help guide you through the process.

■ Rick Orford is a Vancouver Realtor with Dexter Associates Realty. The views expressed are those of the author and not necessarily those of RGF Integrated Wealth Management Ltd., which makes no representations as to their completeness or accuracy. He may be reached any time by phone/text at: 778-832-0132 or via email at [email protected]

Perhaps it’s after the kids have moved out, a desire for more retirement income (i.e. to travel more or pay down debt), or maybe it’s a recent health concern making walking up and down the stairs a challenge. Whatever the reason, making the right choice is no doubt one of the biggest decisions that a homeowner will face, especially considering the lasting effect for years to come.

Before making any big choices, I cannot stress enough the importance of having a team on your side who understands your past and present financial position, in addition to your goals… I like to call this your “Inner Circle”. Just as your financial advisor is an integral part of your team, your accountant will help you ensure your plans are tax-efficient, your banker will assist with your individual borrowing needs, your lawyer will keep you safe, and your realtor will advise you on matters related to real estate. These professionals, or your inner circle, offer important advice that cannot be underscored enough.

Making the best use of built-up equity

Downsizing is a popular way to make good use of the equity in your home, but you must make sure it’s worth it! Some of the uses of the remaining equity might include:

Pay off outstanding debt

The remaining equity can be used to pay off persistent debt such as credit cards or a car loan.

Your Inner Circle will help you come up with a plan that meets your unique and individual needs.

Wealth DistributionIn my experience, wealth distribution is a key consideration with baby boomers nearing retirement. They want to make sure their children get best use of the equity built up from the family home. This equity is often used as an “early inheritance” that goes toward the children’s down payment toward their first home. Your lawyer will be a key advisor on this matter.

Retirement income

Your financial advisor can help turn home equity into increased income in retirement. Depending on your situation, the increase in cash flow could be considerable. Your financial advisor will be a key asset in this conversation as preservation of these funds will likely be a key.

Travel

Who doesn’t want to travel more? The remaining equity and/ or increased cash flow can certainly help get you travelling more.

Finding an ideal new home

If you’ve made the decision to start exploring the idea of moving to a different, less expensive (and perhaps smaller) home, your realtor will start with a market evaluation of your home and identify its potential selling price in its current condition and market. To find this out, subtract any outstanding mortgages and closing costs, and the cost of your new property. Your realtor can help you work out your own individual numbers.

You will also want to consider the type of property you might want to move to. Is it a smaller single- level home, or perhaps a condominium? And what about the area? You’ll want to think about being close to healthcare, grocery stores, public transportation etc. Also, do you want an indoor pool and fitness facility?

You will find that moving to a less expensive area will help you obtain a larger space, while keeping more of the equity from the sale of the property.

Other Considerations

Watch out for monthly strata fees, taxes, and small repairs that you might want to complete prior to, or shortly after, moving in.

Project Home

For those who are willing to take on a project, they might also consider a property that needs a renovation. Properties that are in “original” condition offer an opportunity to renovate to the buyer’s exact liking, thereby making it their own, and usually, for less money than what the property would have sold for in its renovated state.

Bottom line: The equity in your home can be a powerful retirement planning tool. Stay in touch with your Inner Circle to help guide you through the process.

■ Rick Orford is a Vancouver Realtor with Dexter Associates Realty. The views expressed are those of the author and not necessarily those of RGF Integrated Wealth Management Ltd., which makes no representations as to their completeness or accuracy. He may be reached any time by phone/text at: 778-832-0132 or via email at [email protected]

You might also be interested in...

Why do we plan?

Knowing where you are translates into knowing where you’re going, and we hope to provide every client with the trust and confidence to navigate through the waters of their financial lives.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.