The Case for Active Management with your Fixed Income

Apr 05, 2019

As financial advisors, we make investment recommendations for your portfolio that are based on many factors, including your risk tolerance, investment objectives and your time horizon. The recommended investment mix often includes a combination of equities (or businesses) and fixed income.

Within either asset class, there are numerous investment options to choose from. Also, there is a choice to invest passively (in an index or index equivalent, or by buying individual bonds) or actively (where a fund manager or fund management team actively makes investment decisions).

For this article, I will focus on why active management is important for your fixed income allocation.

1. Individual bond returns are highly skewed

In general, the most a bond can return is the principal and interest until the bond reaches its maturity date.

Some bonds return far less due to default, or (forced) premature sales due to a credit rating downgrade, or other reasons. With active management, a manager can potentially add alpha (a premium in excess of the market return) to a fixed income portfolio by either being offensive or defensive as the situation warrants. For example, active managers focus a lot of their research on credit analysis. Based on their research, they look for opportunities where the current credit rating (as rated by the bond rating agencies) of a bond does not match their findings. Credit downgrades create forced selling by passive holders of fixed income, as many institutions and passive funds are required to only hold investment grade fixed income. Active managers look to avoid bonds that have the potential of being downgraded and will sometimes purchase bonds at a discount after they have been downgraded (if they see value in those bonds).

2. Bond indices are different from equity indices

Most equity benchmarks are capitalization weighted, whereby the weights are determined by the size (market capitalization) of the companies. With bond indices, on the other hand, weightings reflect how much debt a company or government issues and the size of an individual security issued. Therefore, when a company issues more debt, its weight in a bond index increases.

Why would an investor want to increase their holdings in a company’s liabilities because the company has increased their leverage? For example, if you have two friends that you have loaned funds to and one of them has no other debt and lots of assets, whereas the second friend has maxed his lines of credit and credit cards, would you want to loan even more money to the second friend?

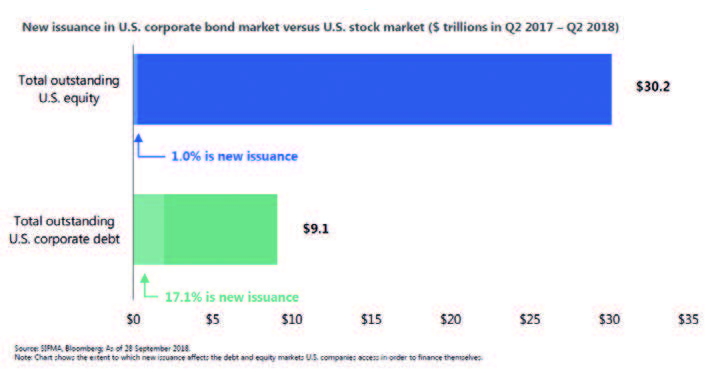

3. The new issuance market is important for bonds

New securities make up around 17% of bond market capitalization; whereas new (equity) securities represent only 1% for the equity markets. This makes sense, as common equity is generally a perpetually lived security, whereas bonds have finite maturities. As new bonds come to market, active managers in the new issue market can add value through strong credit analysis and an understanding of technical trading.

4. Bond trading and complexity

Most bond purchases and sales are not simple orders, they are negotiations. The outcome is determined not only by the interest, but also by several other factors affecting the two parties that are negotiating. One factor that benefits active managers is the volume of their transactions, as they can minimize transaction costs through economies of scale. Another factor is their understanding of the covenants or indentures within each bond issue. A bond covenant is a legally binding term of agreement between a bond issuer and a bondholder. A combined approach of picking the bonds with the strongest fundamentals, and a full understanding of the covenants, will place investors in the best position on a risk-adjusted basis.

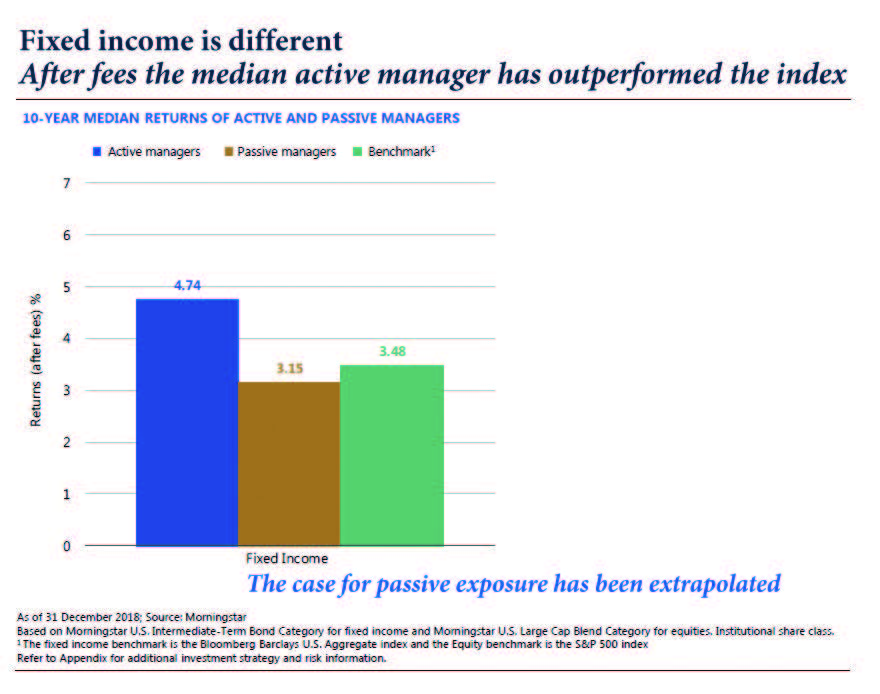

5. Active bond managers have outperformed their benchmark

The median active bond manager has outperformed his or her passive counterpart by more than 1.25 percent over the last 10 years. This differential is substantial, as it compounds over time and represents a meaningful total return. Another key thing to note here is that passive managers typically underperform the index, due to fees.

There are several other reasons why it makes sense to employ active management for your portfolio’s fixed income allocation. These include the ability to screen for environmental, social and governance (ESG) issues, overweighting or underweighting a particular country or company based on currency exposure, and changing the duration on the portfolio based on interest rate forecasts. The global bond market is significantly larger than the global stock market and it pays to rely on active management.■

Estate Planning Misconceptions

In this 5-minute webinar, we explore an important but often misunderstood area of financial planning.

Learn More