What You Need to Know about Dividends

Oct 07, 2022

If you own stocks in your investment portfolio – either directly or through mutual funds or exchanged-traded funds – you are a part owner in multiple businesses.

This entitles you to a portion of the profits that these companies earn. It is a key reason why investing in stocks has been such a successful generator of long-term wealth over the last century.

What Are Dividends?

A dividend is part of the profits a business makes that it pays to its shareholders (owners). Most companies set aside some of their earnings to aid in future growth and then return the rest to shareholders in the form of dividend payments.

A young, fast-growing company might choose to forgo paying dividends, choosing instead to focus solely on the future expansion of the business. However, as a company becomes more mature and growth slows, it tends to distribute a larger and larger percentage of its profits as dividends.

Over the last century, approximately one-third of the total return of the stock market has come from dividends.

Dividend-Paying Stocks Tend to Outperform

Mounting evidence suggests that shares of companies that pay dividends out-perform shares of companies that do not pay dividends over the long term. From 1973 through 2021, stocks in the S&P 500 Index that paid dividends averaged a return of 9.6% per year, compared to a 4.8% annual return for stocks that did not pay dividends.

Furthermore, dividend-paying stocks were less volatile than the overall market during that nearly 50-year period. There is an intuitive reason for this: companies that pay dividends tend to be consistently profitable and therefore better prepared to navigate recessions and other challenging periods than non-dividend payers.

Dividend Growth

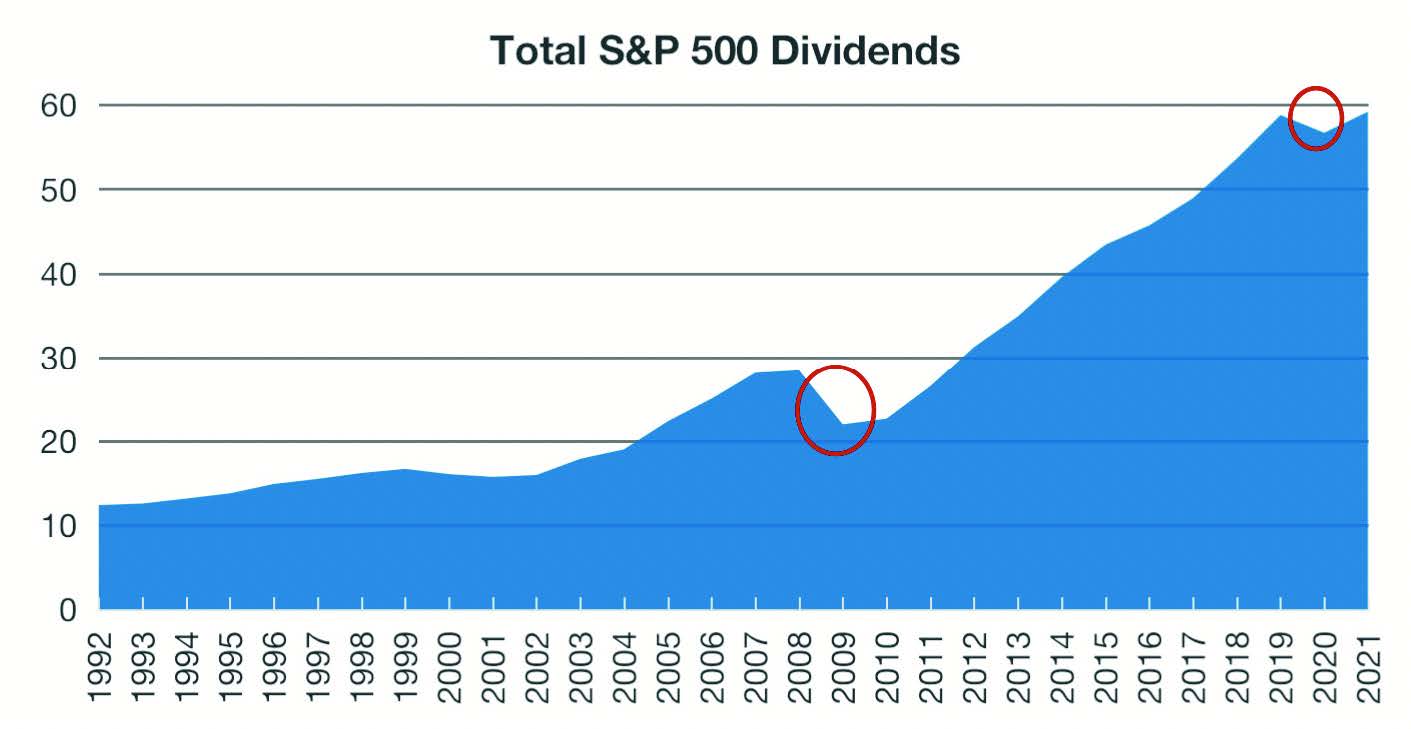

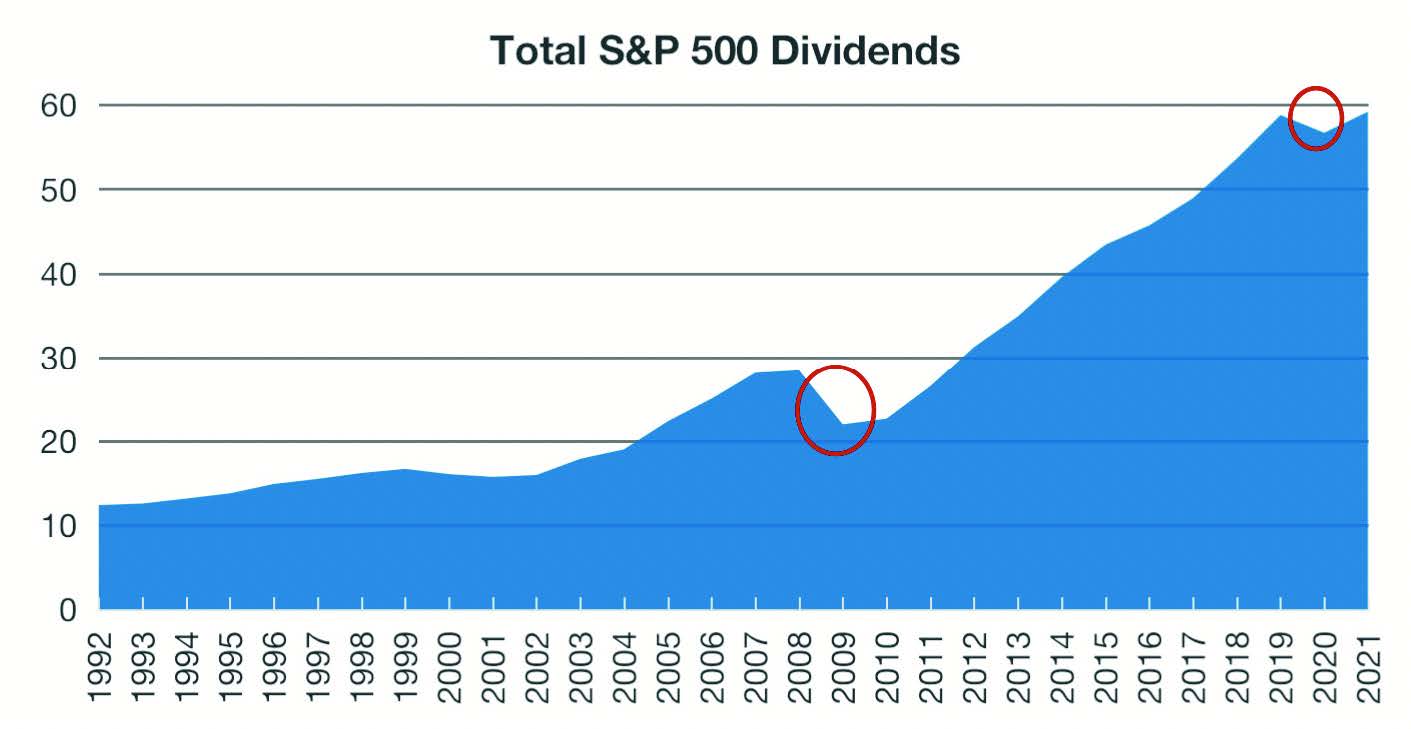

While the stock market can fluctuate significantly from one month or year to the next, the dividends paid by the largest companies in the world tend to be much more predictable. Over the last 25 years, the total amount of dividends paid by companies in the S&P 500 Index has increased nearly fivefold. During this period, there were only two brief stints when dividends declined meaningfully in aggregate: the financial crisis of 2008 and the onset of the coronavirus pandemic in 2020.

There is a subset of companies – known as dividend aristocrats – that have an impressive track record of dividend increases going back multiple decades. Some notable examples of dividend aristocrats include:

• Johnson & Johnson: The company that makes medical and household products such as Tylenol and Listerine has increased its dividend every year for the last 60 years.

• Procter & Gamble: All of us have Procter & Gamble products in our homes, as this company owns numerous consumer brands including Tide, Gillette, Crest, Head & Shoulders, and Pampers. The company has paid a dividend for 132 consecutive years and has increased this dividend for 66 straight years and counting.

• Walmart: The largest retailer in the world, Walmart recently raised its dividend payment to shareholders for the 49th consecutive year.

Inflation has been the most important economic variable over the last 12 months. Dividends are one of the best long-term ways to guard against inflation because companies can raise prices of the goods and services they provide and pass along a portion of these increased profits in the form of higher dividend payments. When the stocks in your portfolio grow their dividends, it’s as if you are getting a raise without doing any additional work!

Tax Treatment of Canadian Dividends

Besides the evidence that dividend-paying stocks tend to out- perform the overall market and dividends make up a meaningful portion of overall stock market returns, there is an additional benefit to owning Canadian dividend-paying stocks in non-registered (taxable) accounts.

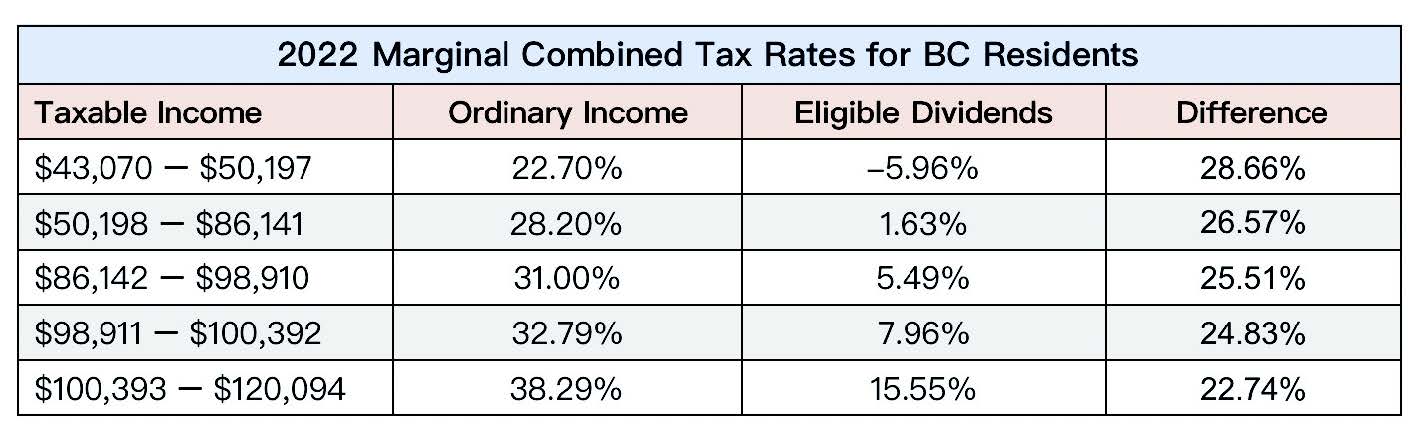

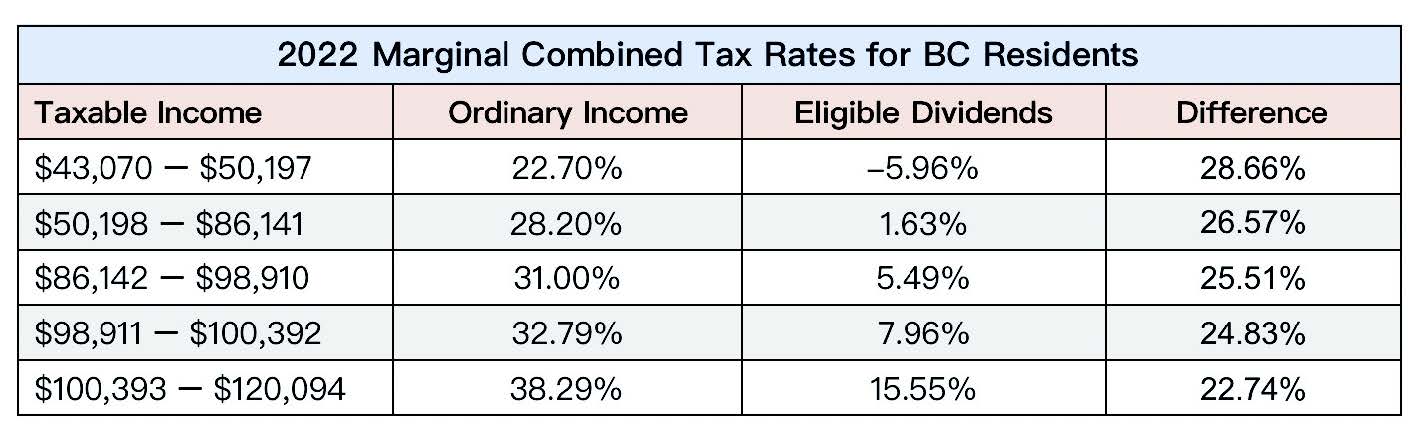

Dividends paid by large Canadian corporations (known as “eligible dividends”) are taxed at a significantly lower rate than most other types of income (such as interest paid by bonds) and if your taxable income is below $50,197 (as of 2022), your tax rate on eligible dividends is negative. Said another way, the dividend tax credit you receive is higher than the tax you pay on the dividends themselves.

Even for individuals in higher tax brackets, eligible dividends paid by Canadian companies are highly tax-efficient. (See below)

There are also tax benefits that can be achieved by investing in dividend-paying Canadian stocks within a corporately owned investment account. This is beyond the scope of this article, but it is something you can discuss with your Financial Advisor to learn more about.

Summarizing Dividends

Most Canadians are employees rather than business owners. However, by investing in dividend-paying companies, you are able enjoy one of the main benefits of business ownership – a share of the profits! There are numerous ways of getting exposure to dividend stocks; your Advisor can discuss these with you in detail and determine how they can help you achieve your financial objectives.■

Sources -

S&P Dow Jones Indices: https://www.spglobal.com/ spdji/en/research/article/ a-fundamental-look-at-sp-500- dividend-aristocrats/

Hartford Funds: Ned Davis Research: https://www.hartfordfunds.com/dam/en/docs/pub/ whitepapers/WP106.pdf

This entitles you to a portion of the profits that these companies earn. It is a key reason why investing in stocks has been such a successful generator of long-term wealth over the last century.

What Are Dividends?

A dividend is part of the profits a business makes that it pays to its shareholders (owners). Most companies set aside some of their earnings to aid in future growth and then return the rest to shareholders in the form of dividend payments.

A young, fast-growing company might choose to forgo paying dividends, choosing instead to focus solely on the future expansion of the business. However, as a company becomes more mature and growth slows, it tends to distribute a larger and larger percentage of its profits as dividends.

Over the last century, approximately one-third of the total return of the stock market has come from dividends.

Dividend-Paying Stocks Tend to Outperform

Mounting evidence suggests that shares of companies that pay dividends out-perform shares of companies that do not pay dividends over the long term. From 1973 through 2021, stocks in the S&P 500 Index that paid dividends averaged a return of 9.6% per year, compared to a 4.8% annual return for stocks that did not pay dividends.

Furthermore, dividend-paying stocks were less volatile than the overall market during that nearly 50-year period. There is an intuitive reason for this: companies that pay dividends tend to be consistently profitable and therefore better prepared to navigate recessions and other challenging periods than non-dividend payers.

Dividend Growth

While the stock market can fluctuate significantly from one month or year to the next, the dividends paid by the largest companies in the world tend to be much more predictable. Over the last 25 years, the total amount of dividends paid by companies in the S&P 500 Index has increased nearly fivefold. During this period, there were only two brief stints when dividends declined meaningfully in aggregate: the financial crisis of 2008 and the onset of the coronavirus pandemic in 2020.

There is a subset of companies – known as dividend aristocrats – that have an impressive track record of dividend increases going back multiple decades. Some notable examples of dividend aristocrats include:

• Johnson & Johnson: The company that makes medical and household products such as Tylenol and Listerine has increased its dividend every year for the last 60 years.

• Procter & Gamble: All of us have Procter & Gamble products in our homes, as this company owns numerous consumer brands including Tide, Gillette, Crest, Head & Shoulders, and Pampers. The company has paid a dividend for 132 consecutive years and has increased this dividend for 66 straight years and counting.

• Walmart: The largest retailer in the world, Walmart recently raised its dividend payment to shareholders for the 49th consecutive year.

Inflation has been the most important economic variable over the last 12 months. Dividends are one of the best long-term ways to guard against inflation because companies can raise prices of the goods and services they provide and pass along a portion of these increased profits in the form of higher dividend payments. When the stocks in your portfolio grow their dividends, it’s as if you are getting a raise without doing any additional work!

Tax Treatment of Canadian Dividends

Besides the evidence that dividend-paying stocks tend to out- perform the overall market and dividends make up a meaningful portion of overall stock market returns, there is an additional benefit to owning Canadian dividend-paying stocks in non-registered (taxable) accounts.

Dividends paid by large Canadian corporations (known as “eligible dividends”) are taxed at a significantly lower rate than most other types of income (such as interest paid by bonds) and if your taxable income is below $50,197 (as of 2022), your tax rate on eligible dividends is negative. Said another way, the dividend tax credit you receive is higher than the tax you pay on the dividends themselves.

Even for individuals in higher tax brackets, eligible dividends paid by Canadian companies are highly tax-efficient. (See below)

There are also tax benefits that can be achieved by investing in dividend-paying Canadian stocks within a corporately owned investment account. This is beyond the scope of this article, but it is something you can discuss with your Financial Advisor to learn more about.

Summarizing Dividends

Most Canadians are employees rather than business owners. However, by investing in dividend-paying companies, you are able enjoy one of the main benefits of business ownership – a share of the profits! There are numerous ways of getting exposure to dividend stocks; your Advisor can discuss these with you in detail and determine how they can help you achieve your financial objectives.■

Sources -

S&P Dow Jones Indices: https://www.spglobal.com/ spdji/en/research/article/ a-fundamental-look-at-sp-500- dividend-aristocrats/

Hartford Funds: Ned Davis Research: https://www.hartfordfunds.com/dam/en/docs/pub/ whitepapers/WP106.pdf

You might also be interested in...

Why do we plan?

Knowing where you are translates into knowing where you’re going, and we hope to provide every client with the trust and confidence to navigate through the waters of their financial lives.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.