RRIF withdrawal rates

Jun 15, 2015

In the most recent federal budget, there were some interesting and progressive changes. The most obvious to many was that the TFSA annual deposit limit was changed from $5,500 to $10,000. While this is very helpful for many people, let's talk about the changes to the RRIF withdrawal rates.

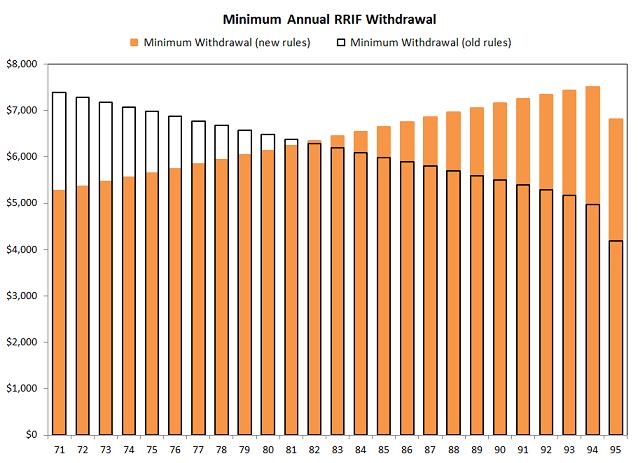

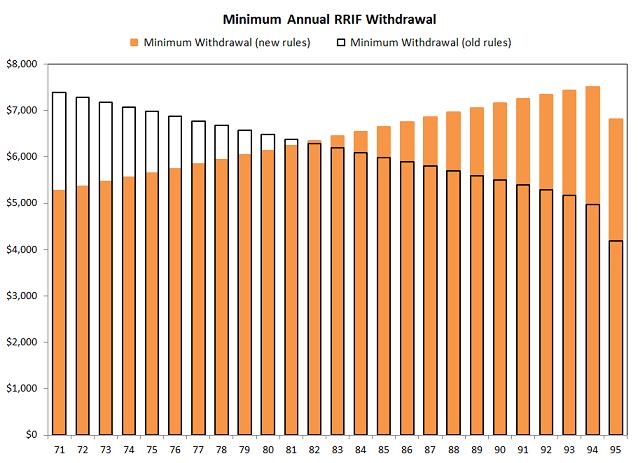

Over the years, there have been various changes to the RRIF rules. This time around, the government did not change the age at which one must convert an RRSP to a RRIF. That still has to take place in the year that you turn 71 (income to begin in the following calendar year). This time, they changed the amount that you have to withdraw. Under the old rules, in the first year of your RRIF, you had to withdraw 7.38% of your capital (calculated on the first day of the new year). Each year from there, the amount you had to draw increased. Based on current interest rates and average life expectancy, the old withdrawal factors needed to be changed.

Change them they did. Now in the first year of your RRIF, you have to draw out 5.28%. The changes more accurately reflect recent long-term rates of return and life expectancy.

These new rates will help seniors preserve capital for longer and will reduce the chances of outliving your savings.

To demonstrate the RRIF income below, we assume an individual's age to be 71 at the beginning of the year, with a RRIF account value of $100,000 and a 5% annual investment rate of return over the life of the RRIF. (The orange bars represent the new annual minimum withdrawals from a RRIF account while the clear bars with black borders reflect the annual minimum withdrawals under the old rules.)

Over the years, there have been various changes to the RRIF rules. This time around, the government did not change the age at which one must convert an RRSP to a RRIF. That still has to take place in the year that you turn 71 (income to begin in the following calendar year). This time, they changed the amount that you have to withdraw. Under the old rules, in the first year of your RRIF, you had to withdraw 7.38% of your capital (calculated on the first day of the new year). Each year from there, the amount you had to draw increased. Based on current interest rates and average life expectancy, the old withdrawal factors needed to be changed.

Change them they did. Now in the first year of your RRIF, you have to draw out 5.28%. The changes more accurately reflect recent long-term rates of return and life expectancy.

These new rates will help seniors preserve capital for longer and will reduce the chances of outliving your savings.

To demonstrate the RRIF income below, we assume an individual's age to be 71 at the beginning of the year, with a RRIF account value of $100,000 and a 5% annual investment rate of return over the life of the RRIF. (The orange bars represent the new annual minimum withdrawals from a RRIF account while the clear bars with black borders reflect the annual minimum withdrawals under the old rules.)

You might also be interested in...

Estate Planning Misconceptions

In this 5-minute webinar, we explore an important but often misunderstood area of financial planning.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.