Question from Ed (Alberta): I’m 53, unmarried, and plan to retire in five years. I have $350,000 in my RRSP. What would be the best strategy - cash in $30,000 of my RRSP a year before I collect the Canada pension, or create a self-directed annuity which I can then use to draw out $30,000 a year? I have no other pensions and I expect that $30,000 a year, less taxes, should be more than enough given that my home is paid for.

*****************

Clay Gillespie is a financial adviser, portfolio manager and managing director of Rogers Group Financial in Vancouver.

"A 53-year-old man has a life expectancy of another 31.7 years (for a total of 84.7). Most people assume that life expectancy is the same as lifespan. This is not correct. Instead, life expectancy is a median number of years – such that 50 per cent of a particular age group will die before this number of years, and the other 50 per cent will die after. A 53-year-old male has a 32-per-cent chance of reaching 90 and a 15-per-cent chance of reaching age 95.

Next, you need to decide your investment risk tolerance because that will have a dramatic effect on how much income you can generate in retirement. Typically, with the right strategies, the higher the equity allocation (stocks, real estate investment trusts, etc.), the higher the long-term rate of return. But there is always the possibility of market corrections and loss of capital. Thus you need fixed-income investments (bonds, guaranteed investment certificates, etc.) to reduce the volatility. When you are working, a stock market correction is not an income problem as you are getting an income from work, but when you are retired it is more important as you are drawing an income from your investments.

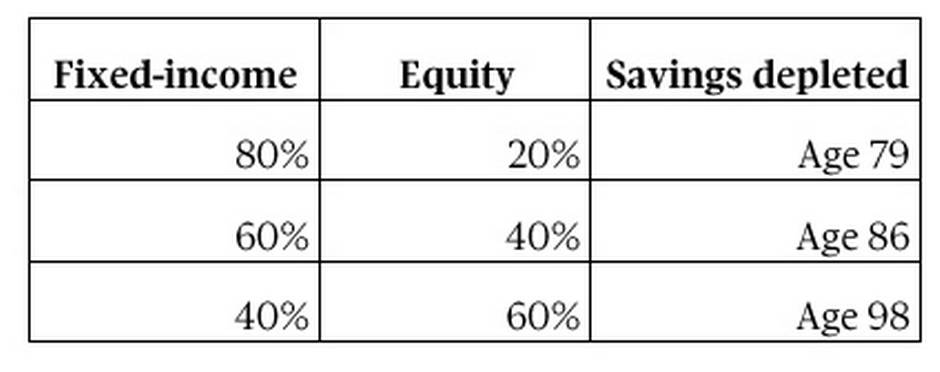

The following chart gives an idea of possible outcomes for a 53-year-old man (retiring at 58 at certain risk tolerances based upon historical results) generating a net spendable income (after tax and after inflation income) of $30,000 a year. You need to make sure that you keep up with rate of inflation to maintain your standard of living. The chart does not include the equity in a principal residence. It does include Old Age Security and Canada Pension Plan.

I do not recommend that individuals invest more than 60 per cent of their portfolio in equity-based investments in retirement.

Upon retirement you should transfer funds into a registered retirement investment fund (RRIF) and generate your desired income. You should start your CPP at 60 and OAS at 67 (or 65 if the date is changed back). I would suggest you do not consider buying a life annuity (personal pension) until you are in your mid-70s."