Lessons from History – The Legend of Abraham Wald

Jan 11, 2024

Born in Kolozsvar, Hungary (now Romania), in 1902, Abraham Wald’s educational journey began with home-schooling before he pursued geometry at the University of Vienna.

He earned his doctorate in 1931 and received an invitation to conduct economic research at Columbia University in 1938. Wald became an integral member of the university’s Statistical Research Group (SRG), using his knowledge to help solve military problems during the Second World War.

It was in 1943 that the military tasked Wald, and the SRG, with finding a solution to a major problem facing the air force – the heavy losses suffered by bomber planes at the hands of German air defences. There were limitations on the amount of armour the planes could carry as it increased fuel consumption and decreased manoeuvrability. The challenge was determining the best way to distribute the available armour in order to minimize losses.

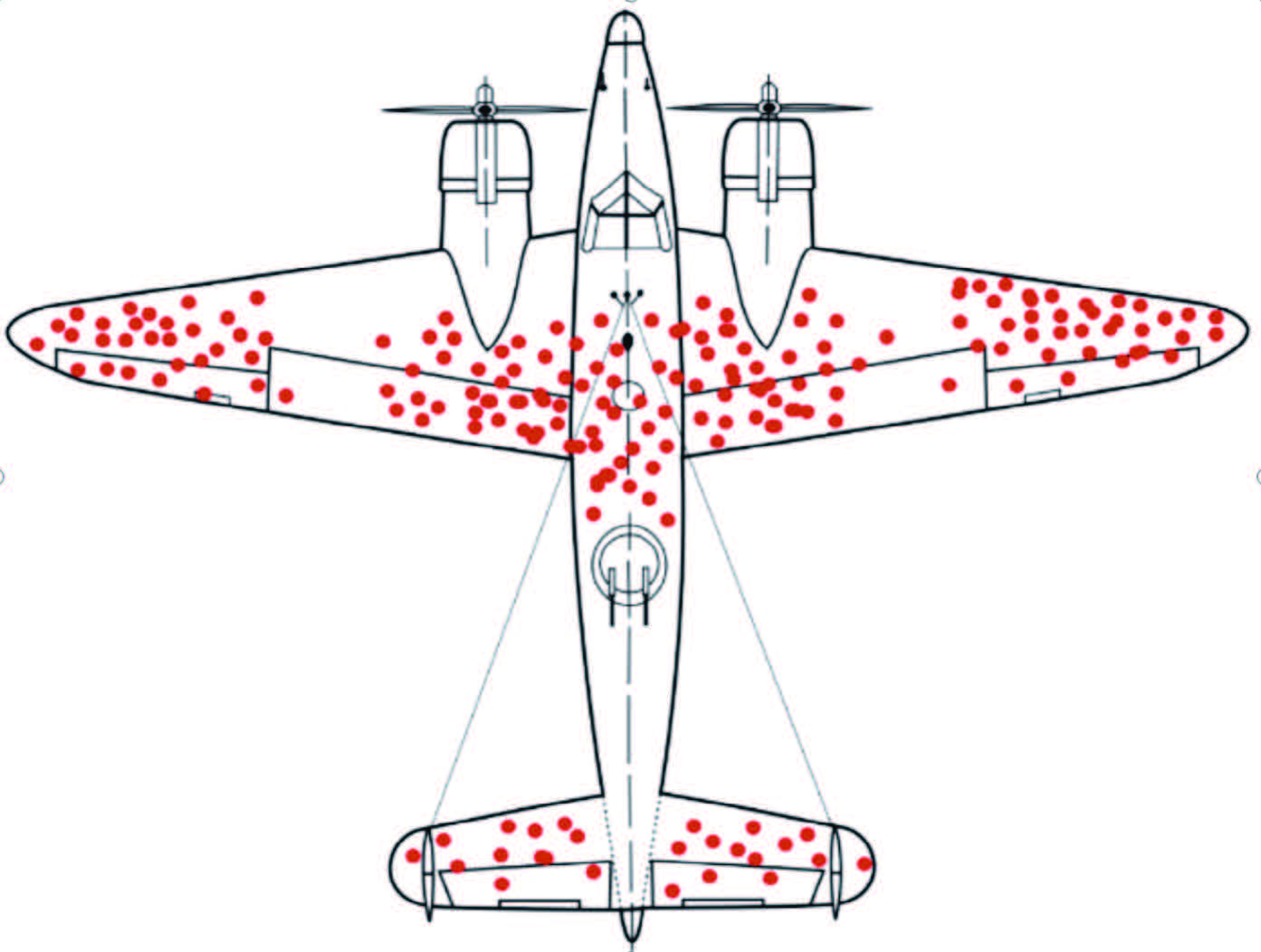

The military provided a lot of data, most notably the location of damage on returning bomber planes.

The intuitive expectation was that the mathematicians would analyze this data and identify areas of greatest need based on the concentration of damage. The recommendation that Wald provided was not one that they expected.

Wald was confident that the bullet holes should be equally distributed across the plane. This led him to the pivotal question – where are the missing holes?

His insightful deduction was that planes damaged in these areas did not return. Consequently, he recommended concentrating armour in areas without bullet holes, such as the engine. The military adopted Wald’s recommendation to great success.

This phenomenon is known as Survivorship Bias – a cognitive error that arises when we focus on the elements that have “survived” a process (returning bomber planes) while overlooking those that did not (bomber planes shot down). In essence, it occurs when our analysis is based solely on the visible and successful outcomes, neglecting the valuable insights that could be gained from the unseen failures. This bias can lead to skewed conclusions and misguided decisions.

Survivorship bias can be a tricky phenomenon to catch as it requires us to factor in data that we do not see. Below are three examples where survivorship bias may be present. For each example, try and identify how the data considered may be incomplete and could potentially lead to a misguided conclusion.

1) What’s the average long-term return of mutual funds?

Data Considered: Average 20-year investment performance of mutual funds.

Survivorship Bias: Poor performing mutual funds are more likely to be closed before establishing a 20-year track record. As a result, their lower returns are not included in the performance data that would provide investors with an overly optimistic view of long-term mutual fund returns.

2) What does it take to be a successful entrepreneur?

Data Considered: Traits and habits of successful entrepreneurs.

Survivorship Bias: Analyzing successful entrepreneurs can create a skewed view of success, overlooking the challenges and luck involved in entrepreneurship. Aspiring entrepreneurs might get unrealistic expectations and miss out on valuable lessons from those who struggled or failed. To have a more realistic understanding, it's crucial to consider a full range of experiences, including both successes and failures in entrepreneurship.

3) Is music from the 1960s better than today’s music?

Data Analyzed: Music played on the radio, TV shows, films, and social media.

Survivorship Bias: The songs from the 1960s that we hear today represent only the finest and most popular tunes of that era. The less appealing music from that time is conveniently omitted. As we encounter only the top-quality music from that period, it creates the illusion that the entire era was uniformly outstanding.

I could list countless more examples of survivorship bias, but the premise would remain consistent. The “unsuccessful” (poor performing mutual funds, failed entrepreneurs, and subpar music) is omitted from the data. There can also be situations where the “successful” is omitted, and this less common phenomenon is called Reverse Survivorship Bias.

We live in a world where success stories are readily shared, and failures often remain unspoken. This bias is on full display when it comes to speculative investments, such as penny stocks and cryptocurrency. When speaking with friends and neighbours, individuals are far more likely to share success stories and stay quiet about failed ventures. During significant corrections in cryptocurrency, it’s as if the asset class doesn’t exist.

Abraham Wald’s story provides an important lesson that can help with our financial planning. By recognizing and accounting for missing information, as Wald did in his analysis of bomber planes, we’re able to develop a complete understanding of the situation. This allows us to make well-informed decisions that move us closer to achieving our goals and objectives. ■

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More