Longevity and Life Annuities

Jul 28, 2022

A couple of questions we commonly get asked are “What is a life annuity?” and “Should I consider a life annuity in my situation?”

A life annuity (similar to a defined pension plan) is a financial product that is issued by a life insurance company. In exchange for a premium (deposit), you receive a monthly income for as long as you live. The payment you receive is based on the current interest rates and your age. A life annuity can be based on one individual, or, in many cases, it can be a joint life annuity (payment continues as long as either annuitant is alive). A life annuity guarantees a stable income regardless of market conditions or changes in interest rates. A life annuity can also be indexed so the income increases every year.

In deciding whether a life annuity is a good idea, it is important to have a discussion about life expectancy. Life expectancy is one of the most misunderstood aspects of retirement income planning. But using only life expectancy as a target could leave many retirees at risk. The reason for this is that life expectancy is a median number – so it’s saying 50% of a particular age will die before this age and 50% will die after. For example, the assumed life expectancy for a woman aged 65 is currently 24 years, but because this is a median number, 50% of all women aged 65 today are expected to live longer than 24 years.

The main disadvantage of a life annuity is that you could die before you receive enough payments to make up your original deposit. The purchase of a life annuity is a form of longevity protection.

Many of the life annuities that we recommend are purchased with registered funds. These funds (RRSPs, LIRAs RRIFs, LIFs, etc.) are fully taxed upon your death. They can be passed on a tax-deferred basis to your spouse upon your death, but they will eventually be fully taxed as income.

In British Columbia, we added an additional tax bracket in 2021 that incomes over $222,420 would be taxed at 53.5% (combined federal and British Columbia tax rates). This number is indexed with inflation and is currently at $227,091. Most of us believe we will never hit this tax bracket, but many of our clients will be far higher than this, and so any remaining registered funds could be taxed at a rate as high as 53.5% upon death.

Registered funds were designed to provide a retirement income for a couple in their retirement years. This type of fund was not designed to be a vehicle to pass assets on to your estate. For this reason, we believe that life annuities can be the perfect solution for some of your registered assets during your retirement years.

However, you can just leave your funds inside a RRIF or LIF and generate your retirement income. This is viable and the predominant way our clients generate their retirement income.

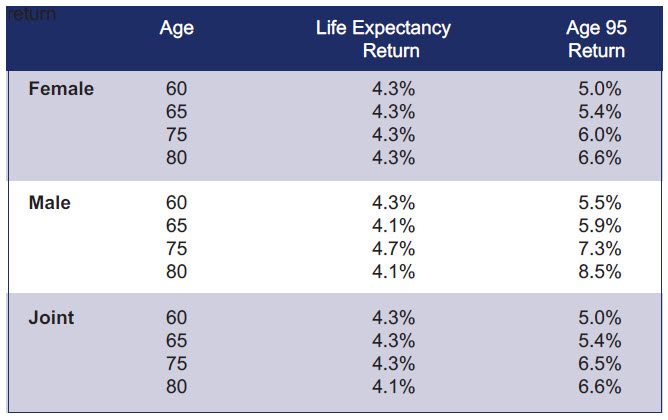

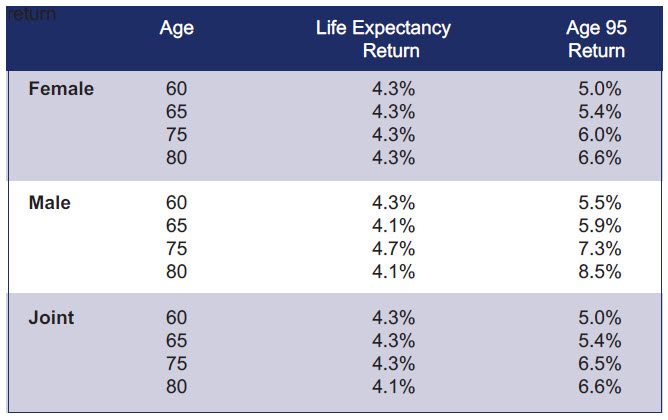

If you review this chart, you can see that the expected return on a life annuity to your life expectancy is currently about 4.3%. You can also see that if you live beyond life expectancy that the return expectations of a life annuity increase. This makes sense as the more payments you receive, the higher your return.

Currently, we believe the most appropriate time to consider purchasing a life annuity (with your registered funds) is when the younger spouse reaches age 75.

Another disadvantage of a life annuity is that the payments are guaranteed and cannot be changed. Therefore, you want to make sure that you have other assets that can be used for possible changing income needs.

Later in your retirement years, we would like to see most of your day-to-day expenses covered by fixed payments (i.e., CPP, OAS, company pension, and/or life annuity) as these payments do not need to be managed and will last as long as you live.

If your funds are currently invested in a balanced portfolio you, would probably want to wait until the recent stock market correction is over before considering an annuity.

Please speak with your financial advisory team if you have any questions about the use of a life annuity in your personal situation. ■

A life annuity (similar to a defined pension plan) is a financial product that is issued by a life insurance company. In exchange for a premium (deposit), you receive a monthly income for as long as you live. The payment you receive is based on the current interest rates and your age. A life annuity can be based on one individual, or, in many cases, it can be a joint life annuity (payment continues as long as either annuitant is alive). A life annuity guarantees a stable income regardless of market conditions or changes in interest rates. A life annuity can also be indexed so the income increases every year.

In deciding whether a life annuity is a good idea, it is important to have a discussion about life expectancy. Life expectancy is one of the most misunderstood aspects of retirement income planning. But using only life expectancy as a target could leave many retirees at risk. The reason for this is that life expectancy is a median number – so it’s saying 50% of a particular age will die before this age and 50% will die after. For example, the assumed life expectancy for a woman aged 65 is currently 24 years, but because this is a median number, 50% of all women aged 65 today are expected to live longer than 24 years.

The main disadvantage of a life annuity is that you could die before you receive enough payments to make up your original deposit. The purchase of a life annuity is a form of longevity protection.

Many of the life annuities that we recommend are purchased with registered funds. These funds (RRSPs, LIRAs RRIFs, LIFs, etc.) are fully taxed upon your death. They can be passed on a tax-deferred basis to your spouse upon your death, but they will eventually be fully taxed as income.

In British Columbia, we added an additional tax bracket in 2021 that incomes over $222,420 would be taxed at 53.5% (combined federal and British Columbia tax rates). This number is indexed with inflation and is currently at $227,091. Most of us believe we will never hit this tax bracket, but many of our clients will be far higher than this, and so any remaining registered funds could be taxed at a rate as high as 53.5% upon death.

Registered funds were designed to provide a retirement income for a couple in their retirement years. This type of fund was not designed to be a vehicle to pass assets on to your estate. For this reason, we believe that life annuities can be the perfect solution for some of your registered assets during your retirement years.

However, you can just leave your funds inside a RRIF or LIF and generate your retirement income. This is viable and the predominant way our clients generate their retirement income.

If you review this chart, you can see that the expected return on a life annuity to your life expectancy is currently about 4.3%. You can also see that if you live beyond life expectancy that the return expectations of a life annuity increase. This makes sense as the more payments you receive, the higher your return.

Currently, we believe the most appropriate time to consider purchasing a life annuity (with your registered funds) is when the younger spouse reaches age 75.

Another disadvantage of a life annuity is that the payments are guaranteed and cannot be changed. Therefore, you want to make sure that you have other assets that can be used for possible changing income needs.

Later in your retirement years, we would like to see most of your day-to-day expenses covered by fixed payments (i.e., CPP, OAS, company pension, and/or life annuity) as these payments do not need to be managed and will last as long as you live.

If your funds are currently invested in a balanced portfolio you, would probably want to wait until the recent stock market correction is over before considering an annuity.

Please speak with your financial advisory team if you have any questions about the use of a life annuity in your personal situation. ■

You might also be interested in...

Why do we plan?

Knowing where you are translates into knowing where you’re going, and we hope to provide every client with the trust and confidence to navigate through the waters of their financial lives.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.