Personal Corporations and Retirement Income Planning

Apr 01, 2013

Many of our clients who operate a small business or professional practice in law, medicine, real estate, or accounting will be incorporated. The primary reasons for incorporating are tax effectiveness, limited liability and organizational effectiveness. This article is about the first motivation: Optimizing your tax position during the accumulation and retirement phases of your financial life cycle.

Many of our clients who operate a small business or professional practice in law, medicine, real estate, or accounting will be incorporated. The primary reasons for incorporating are tax effectiveness, limited liability and organizational effectiveness. This article is about the first motivation: Optimizing your tax position during the accumulation and retirement phases of your financial life cycle. ACCUMULATION PHASE

Without getting into the details of tax legislation, there is an opportunity to realize tax benefits by accumulating savings and investing within a corporate structure.The primary tax advantage of incorporation is the lower rate of tax on active business income generated from operations. In BC, the 2013 tax rate on the first $500,000 of net operating income is 13.5%.

Assuming the business owners have paid themselves what they require for living expenses in the way of either salary, dividends, or a combination of both, the question remains: How to allocate remaining after-tax earnings? Since the earnings remain in the corporation, the initial tax drag on net income is only 13.5%, leaving 86.5% available for reinvestment.

Here are some options:

- Reinvest back into the “operations” of the business

- Pay down debt held inside the corporation

- Invest in “passive” investments within the corporation

All three scenarios result in the growth or accumulation of capital within the corporate structure until the operating business is sold or wound down in preparation for the retirement phase.

RETIREMENT PHASE

What should a business owner do with the savings and investments accumulated within the corporation from retained earnings?

For the purposes of simplicity, we will assume a typical scenario where an income is required from the corporation to augment personal spending in retirement. This leaves us with two primary options:

Option 1

The first option is to invest in passive investments within the corporate structure and only redeem the after-tax investment income that is generated by the portfolio. It is important to note that the very low corporate tax rate on operating income does not apply to passive investment income.

From a tax efficiency perspective, capital gains and dividends are the preferred form of investment income within a corporation.

The benefit of collecting investment income only is that you keep the invested capital intact, but this strategy only works if a sufficient level of income is generated from the invested capital.

Option 2

The second option is to draw down the capital held in the corporation, which leads to the next question: should the capital be drawn down all at once, or over time?

Drawing down the capital in a tax-effective manner is required to avoid loss of income-tested benefits such as Old Age Security (OAS). As such, spending needs, pensions, RRSPs and other savings need to be taken into consideration when determining the method with which corporate savings are withdrawn.

Here are guidelines for both scenarios:

- If the accumulation within the corporation is not significant, there may be an opportunity to wind down the corporation in a single year without paying excessive tax.

- If a significant amount of savings has been accumulated in the corporation, a multi-year drawdown may make more sense to optimize your tax position. A particular challenge is a scenario where a significant pool of RRSPs has also been accumulated. To illustrate this second scenario, we will use a simplified case study:

CASE STUDY

A BC couple both aged 65 have just retired after jointly operating a family business for many years. Their regular spending needs in retirement are approximately $84,000 after taxes.

- After consulting with us, they have elected to collect Canada Pension Plan benefits now, and under new legislation effective July 2013, they have decided to defer Old Age Security Benefits to age 70 for an enhanced benefit.

- They have accumulated $1,000,000 in RRSPs and $600,000 in corporate savings.

- What is the most tax effective method for winding down their corporation?

ANALYSIS AND RESULTS

In this case, it is beneficial to defer drawing down RRSPs until age 70. From age 65 to 69, they have created a “tax window” allowing them to efficiently draw down corporate savings in the form of dividends, over which time all investments and savings from the corporation will be paid out and the corporation effectively wound down.

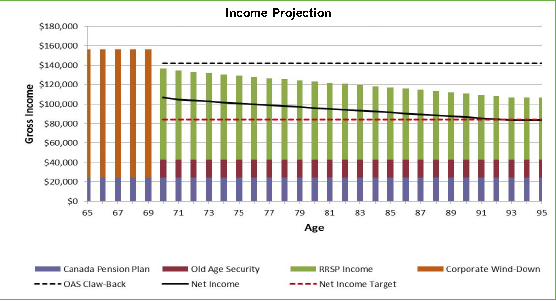

This chart identifies this income structure by mapping the various levels of income from the different sources. The bars represent gross income figures. As illustrated, OAS claw-back (dotted black line) is avoided, and the net income (solid black line) exceeds or meets the target income (dotted red line) until age 90.

This chart identifies this income structure by mapping the various levels of income from the different sources. The bars represent gross income figures. As illustrated, OAS claw-back (dotted black line) is avoided, and the net income (solid black line) exceeds or meets the target income (dotted red line) until age 90.

Income Projection

Averaging approx. $156,000 of annual dividend income from age 65 to 69, split equally, the couple will pay very little tax on the corporate retained earnings as they are paid out the corporation.

If you have an incorporated company with accumulated retained earnings, the benefits of tax planning are obvious.

Estate Planning Misconceptions

In this 5-minute webinar, we explore an important but often misunderstood area of financial planning.

Learn More