The Impact of Foreign Exchange Rates on Investment Returns

Oct 06, 2021

When we think about the value of the Canadian dollar (CAD) in relation to other currencies, our first thought is often our buying power when we travel abroad.

A strong CAD can make the cost of a trip down to the US or over to Europe a lot more economical. I remember travelling to the UK in August 2015 and purchasing GBP at a cost of 2.05 CAD. I soon discovered that I’d chosen the wrong year for this particular vacation, as within 12 months the cost of purchasing GBP had dropped to 1.67 CAD.

While foreign exchange rates can certainly impact the cost of our international vacations, they tend to be fairly minor in relation to our overall financial situation. However, the same cannot be said about the potential impact foreign exchange rates can have on our investment portfolios.

The Canadian stock market comprises only a small percentage (~3%) of total world equity markets. Investing inter- nationally (outside of Canada) is therefore an important aspect of a well-diversified portfolio that has the potential for higher returns and lower volatility. It’s this international investment that introduces a foreign currency component to our investment returns.

Foreign Currency Return = [(Ending FX Rate – Starting FX Rate)/Starting FX Rate]

The US stock market comprises more than 50% of total world equity markets. The size of the US market and close economic ties of our two nations, results in changes to the USD/CAD exchange rate being the most impactful. The impact foreign exchange rates have on investment returns is illustrated in the numerical example below.

Start of the year: 25,000 CAD is invested into a US equity ETF.

Exchange rate is 1 USD/1.25 CAD – investment of 20,000 USD (25,000/1.25).

End of the year: the US equity ETF appreciates to 22,000 USD. (It did not pay distributions) USD (domestic) return is 10% [(22,000 – 20,000)/20,000].

The Canadian dollar adjusted return will depend on the foreign currency return.

Currency Adjusted Return = [(1 + Return in Domestic Currency) x (1 + Foreign Currency Return) - 1]

USD Appreciates (1 USD / 1.35 CAD)

Foreign Currency Return = [(1.35 – 1.25) / 1.25] = 8.0%

Currency Adjusted Return = [(1 + 10%) x (1 + 8%) – 1] = 18.8%

CAD Appreciates (1 USD / 1.15 CAD)

Foreign Currency Return = [(1.15 – 1.25) / 1.25] = -8.0%

Currency Adjusted Return = [(1 + 10%) x (1 + -8%) – 1] = 1.2%

Understanding how foreign exchange rates affect returns can help avoid frustration and uninformed investment management decisions when portfolio returns are not in line with an investor’s expectations. If we assume the ETF’s benchmark also returned 10%, the ETF’s performance would have been average. However, if an investor compared their return to the US benchmark without considering foreign exchange rates, they may incorrectly conclude the investment had a strong performance (18.8%) or poor performance (1.2%) depending on the change in rates.

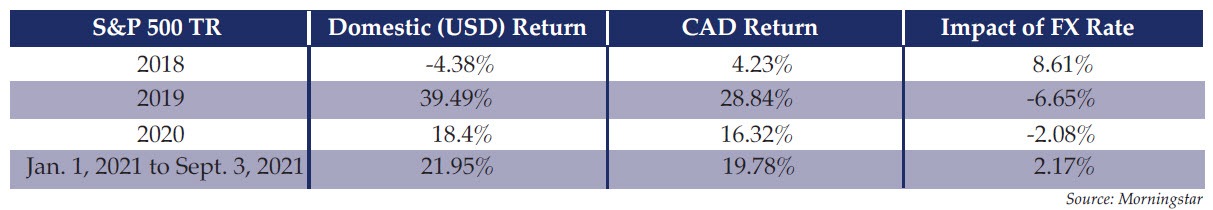

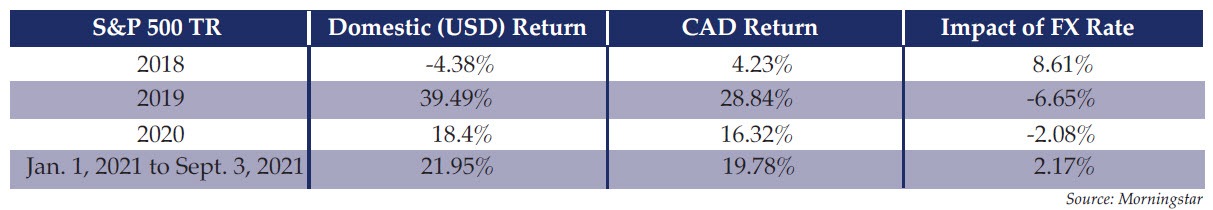

We can see the impact of recent changes in foreign exchange rates by looking at historical return data. The table below shows returns of the US stock market in USD and CAD dating back to 2018. The Bank of Canada’s historical data reports a USD/CAD exchange rate of 1.2517 at the start of January 2018 and an almost identical rate of 1.2518 on September 3, 2021. As a result, the US stock market over this period had near identical cumulative returns (~81%) in both currencies.

US stock market returns are represented by the S&P 500 TR index. This is the total (includes dividends) return of the market capitalization–weighted index of the 500 largest US publicly-traded companies.

Canadian investors experienced a less volatile path to the same return, avoiding a negative year in 2018 and receiving slightly lower returns in the subsequent strong market years.

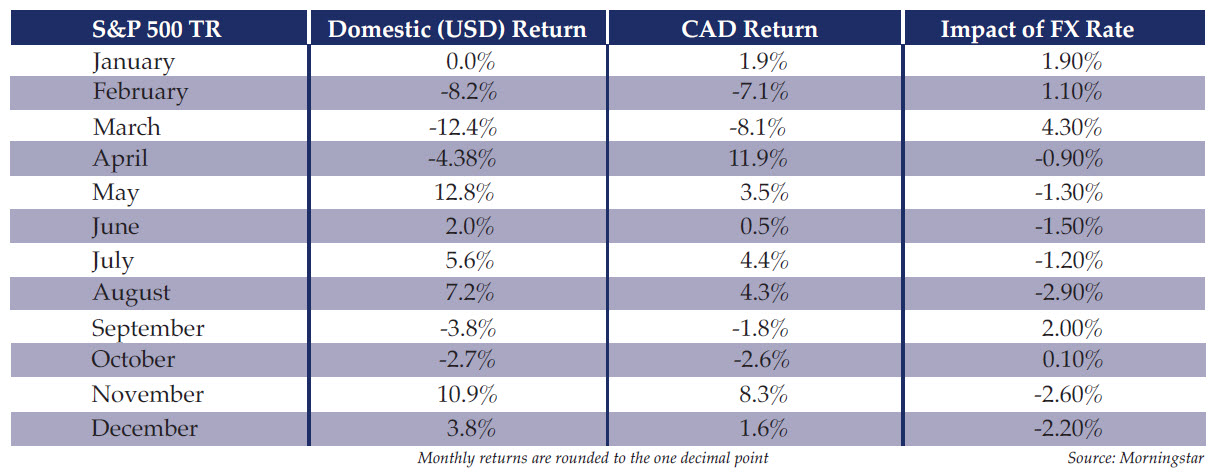

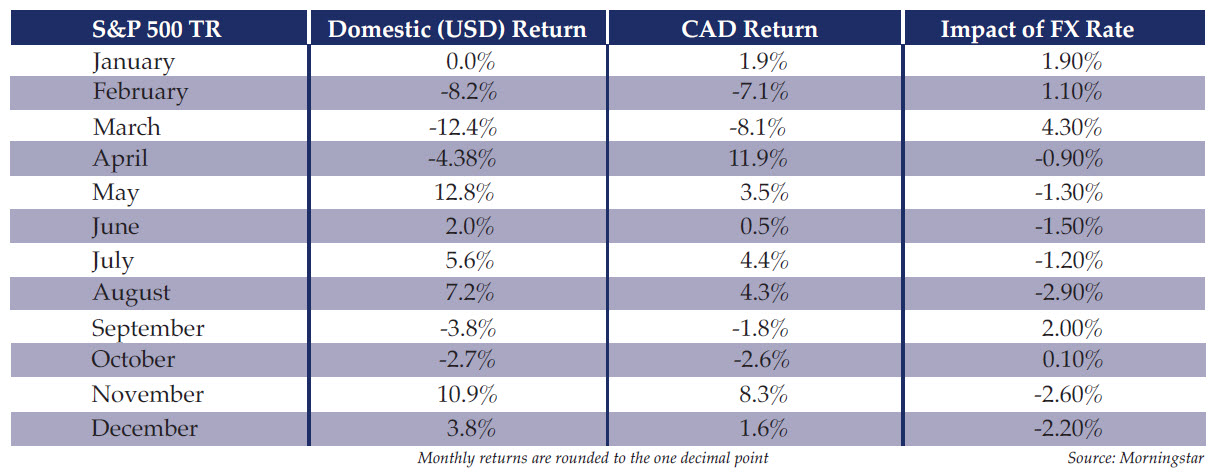

The USD and CAD returns were quite close in 2020. The difference can be attributed to the CAD appreciating against the USD. However, this was a year of substantial short-term volatility, which can be seen when looking at the monthly returns.

The CAD depreciated (against the USD) in each of the five months with a zero or negative return and appreciated in each of the seven months that experienced positive market returns. These changes in the exchange rate had the effect of reducing return volatility while delivering a similar annual return.

The CAD depreciated (against the USD) in each of the five months with a zero or negative return and appreciated in each of the seven months that experienced positive market returns. These changes in the exchange rate had the effect of reducing return volatility while delivering a similar annual return.

This recent reduction in volatility for Canadians investing in US markets has been a welcome trend. While it’s uncertain whether this trend will continue, what we can assume is the return of foreign investments will continue to be impacted by changes in foreign exchange rates.

Canadian investors have the option to purchase international investments that are CAD hedged to remove the impact of foreign exchange on returns. The best course of action will depend on individual circumstances and your RGF advisor can help you determine the right option for your unique situation. ■

A strong CAD can make the cost of a trip down to the US or over to Europe a lot more economical. I remember travelling to the UK in August 2015 and purchasing GBP at a cost of 2.05 CAD. I soon discovered that I’d chosen the wrong year for this particular vacation, as within 12 months the cost of purchasing GBP had dropped to 1.67 CAD.

While foreign exchange rates can certainly impact the cost of our international vacations, they tend to be fairly minor in relation to our overall financial situation. However, the same cannot be said about the potential impact foreign exchange rates can have on our investment portfolios.

The Canadian stock market comprises only a small percentage (~3%) of total world equity markets. Investing inter- nationally (outside of Canada) is therefore an important aspect of a well-diversified portfolio that has the potential for higher returns and lower volatility. It’s this international investment that introduces a foreign currency component to our investment returns.

Foreign Currency Return = [(Ending FX Rate – Starting FX Rate)/Starting FX Rate]

The US stock market comprises more than 50% of total world equity markets. The size of the US market and close economic ties of our two nations, results in changes to the USD/CAD exchange rate being the most impactful. The impact foreign exchange rates have on investment returns is illustrated in the numerical example below.

Start of the year: 25,000 CAD is invested into a US equity ETF.

Exchange rate is 1 USD/1.25 CAD – investment of 20,000 USD (25,000/1.25).

End of the year: the US equity ETF appreciates to 22,000 USD. (It did not pay distributions) USD (domestic) return is 10% [(22,000 – 20,000)/20,000].

The Canadian dollar adjusted return will depend on the foreign currency return.

Currency Adjusted Return = [(1 + Return in Domestic Currency) x (1 + Foreign Currency Return) - 1]

USD Appreciates (1 USD / 1.35 CAD)

Foreign Currency Return = [(1.35 – 1.25) / 1.25] = 8.0%

Currency Adjusted Return = [(1 + 10%) x (1 + 8%) – 1] = 18.8%

CAD Appreciates (1 USD / 1.15 CAD)

Foreign Currency Return = [(1.15 – 1.25) / 1.25] = -8.0%

Currency Adjusted Return = [(1 + 10%) x (1 + -8%) – 1] = 1.2%

Understanding how foreign exchange rates affect returns can help avoid frustration and uninformed investment management decisions when portfolio returns are not in line with an investor’s expectations. If we assume the ETF’s benchmark also returned 10%, the ETF’s performance would have been average. However, if an investor compared their return to the US benchmark without considering foreign exchange rates, they may incorrectly conclude the investment had a strong performance (18.8%) or poor performance (1.2%) depending on the change in rates.

We can see the impact of recent changes in foreign exchange rates by looking at historical return data. The table below shows returns of the US stock market in USD and CAD dating back to 2018. The Bank of Canada’s historical data reports a USD/CAD exchange rate of 1.2517 at the start of January 2018 and an almost identical rate of 1.2518 on September 3, 2021. As a result, the US stock market over this period had near identical cumulative returns (~81%) in both currencies.

US stock market returns are represented by the S&P 500 TR index. This is the total (includes dividends) return of the market capitalization–weighted index of the 500 largest US publicly-traded companies.

Canadian investors experienced a less volatile path to the same return, avoiding a negative year in 2018 and receiving slightly lower returns in the subsequent strong market years.

The USD and CAD returns were quite close in 2020. The difference can be attributed to the CAD appreciating against the USD. However, this was a year of substantial short-term volatility, which can be seen when looking at the monthly returns.

The CAD depreciated (against the USD) in each of the five months with a zero or negative return and appreciated in each of the seven months that experienced positive market returns. These changes in the exchange rate had the effect of reducing return volatility while delivering a similar annual return.

The CAD depreciated (against the USD) in each of the five months with a zero or negative return and appreciated in each of the seven months that experienced positive market returns. These changes in the exchange rate had the effect of reducing return volatility while delivering a similar annual return.This recent reduction in volatility for Canadians investing in US markets has been a welcome trend. While it’s uncertain whether this trend will continue, what we can assume is the return of foreign investments will continue to be impacted by changes in foreign exchange rates.

Canadian investors have the option to purchase international investments that are CAD hedged to remove the impact of foreign exchange on returns. The best course of action will depend on individual circumstances and your RGF advisor can help you determine the right option for your unique situation. ■

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.