Winning By Not Losing

Apr 21, 2023

Nostradamus does not work on Wall Street (it would be nice if he did!). The idea that the best investment managers have a crystal ball is not accurate. However, the most successful managers have a disciplined process that has nothing to do with predicting the future.

There are several ways to reduce your returns, and almost all of them are behaviour-related. Knee-jerk reactions cause most of the long-term problems in portfolios. One of the most common return-reducing factors is not understanding the difference between the stock market and the economy. This issue is a key element of the Behaviour Gap, which is the difference in return received by an investor compared to the return of the investment over time.

The information utilized to measure economic growth is backward looking (e.g., GDP growth, corporate earnings, unemployment, interest rate changes, recessions, bankruptcies). The stock market is considered forward looking. Global capital markets act today based on expectations looking 6 –18 months in the future. The misconception that the economy is the stock market, and the stock market is the economy often leads individuals to make suboptimal decisions around their retirement portfolios. This confusion flows through as lower long-term investor returns. For example, “now is not a good time to invest because the economy is doing poorly.” Primarily using backward-looking data is not a sage portfolio strategy to make forward-looking decisions.

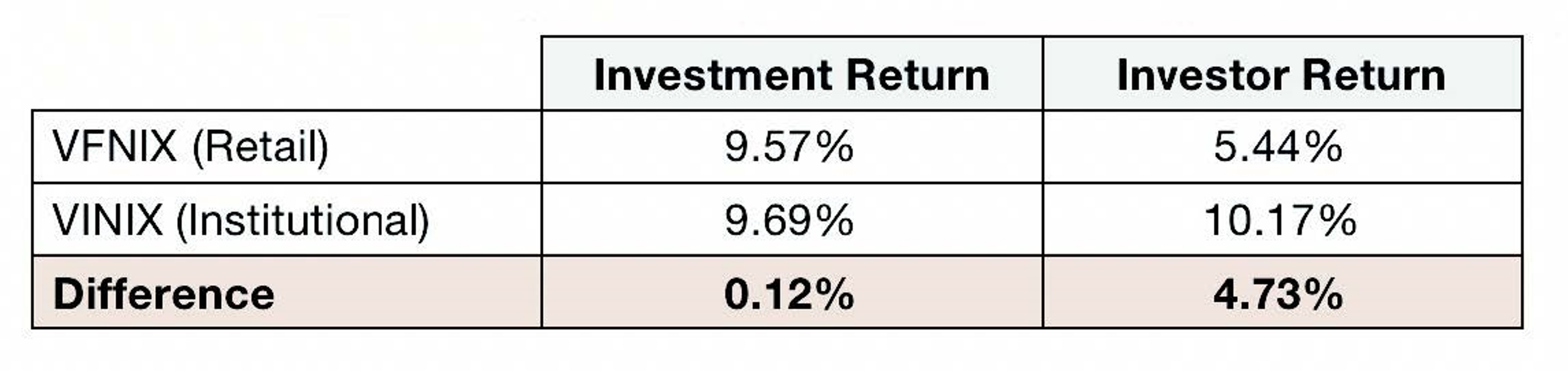

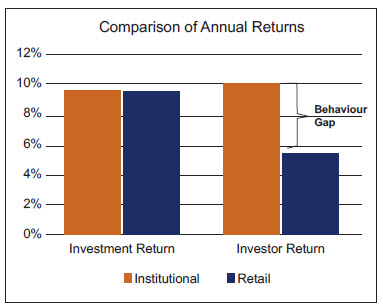

Two individuals investing in the same asset can have wildly different investment experiences. For the purposes of this case study, we use a 15-year investment time horizon. We compare the returns of two index funds that invest in the same 500 large US stocks. One is available to the public (Vanguard 500 Index Fund - VFNIX) and is primarily owned in self-directed accounts. The second option is the institutional version (VINIX), which is offered to large institutions, pension managers, and Portfolio Managers. These investments have different names, but the same underlying holdings.

The following analysis shows that staying the course with a quality investment strategy over time provides a higher probability of success than trying to time the market. Take a scenario of two investors who invest in the same Vanguard ETF, but different versions. One is accessible to the public and the other is the institutional version. VFNIX has a 15-year return to the investor of5.44% net of fees. VINIX has a15-year return of 10.17% net of fees. How is that possible if these two assets invest in the same areas, in the same allocations, for the same period? How do they produce different investment experiences? In this example, the behaviour gap equates to a compounded annual difference of 4.73% per year. It must be fees! But the fee difference between these two assets is 0.1%,which doesn't explain the performance difference.

The following data provided by Morningstar shows the difference in annual return earned by the investors of these two nearly identical funds:

The lower return (the behaviour gap) is due to the poor timing of the investors in the retail version of the fund. One common aspect of this is not being invested when the positive returns occur. This is caused by getting in and out of the market at inopportune times and missing the large positive days, which cannot be predicted in advance with any certainty. Missing many of the up days has caused this trading strategy to reduce the return by more than 4% per year when compared to staying the course through all the difficulties. Over a 15-year period, this translates into a substantial difference in return; the average retail investor would turn $10,000 into $22,135, while the average investor in the institutional version of the fund would turn $10,000 into $42,751 – nearly $20,000 more!

The behaviour gap can be found across all diverse types of asset classes. Taking part in all the up days means one needs to take part in all the down days as well. The highest return days, weeks, and months statistically happen just after the worst days, weeks, and months. Primarily using backward-looking information to make future investment decisions is often hurtful to your long-term returns when it is the basis of your investment philosophy. The key is to understand that the stock market and the economy are not the same thing, and ensure you have a plan that is realistic and measurable.

Taking these steps will allow you to make the most informed financial decisions for you and your family. ■