With the pandemic now stretching out more than 18 months, we’re all looking for a way to move ahead. Vaccines have assisted us in getting some semblance of normality back in our professional and private lives. Now is an opportune time to assess our own financial situations, simplify our lives, and build healthy habits for the future.

The last 18 months has seen a shift in people’s saving behaviours. According to Statistics Canada, savings rates are almost double pre-pandemic rates (7.6 percent to 14.2 percent) and are in ranges we saw in the 1970s, 80s and 90s. Much of the savings was a gut reaction to the uncertainty of the future. Now the question becomes: Do we return to the consumption behaviours of the last 20 years, which saw lower than average savings rates or use these savings to benefit our futures.

When we think of money and self care, we often envision things we value such as vacations, massages and spa days, or time out socializing with family and friends. While we all want and frankly need these things again, the savings we have accumulated can also springboard us financially.

Some areas of financial self care you may wish to explore with these savings might be:

Paying down debt

Interest rates are near all-time lows and financing debt is very low, but that won’t last forever. Personal debt (credit cards, mortgages, student debt) is one of the largest stress factors when people assess their financial lives and many just ignore it hoping it will go away.

Eliminating or reducing debt not only helps financially, but it also removes the mental and physical stress that debt creates. Think about debt you’ve had in life. Does or did debt mean working more and sacrificing family time, worrying about how the debt was affecting your future or negatively affect your relationships. All these stresses lessen as you eliminate the burden of debt and in turn, are positive on many different facets of your life.

Maximizing investments for your future

Making the decision to save for the future versus consuming in the moment can have profound benefits. We live in a society fixated on immediate gratification and it can be difficult to give up on that amazing feeling we get each time we splurge on ourselves. Most people come from humble upbringings. Implementing some of those values our parents taught us may be just what the doctor ordered.

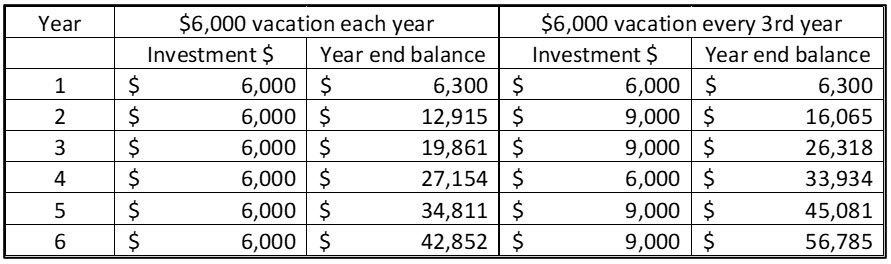

Let’s take a quick example of altering consumption. Let’s suppose you can save $12,000 per year. Normally, you would take a $6,000 family vacation and invest the rest. Instead, let’s say you only take that $6,000 vacation every third year and in the other years, you enjoy a more modest $3,000 vacation. The results after 6 years, supposing a 5% annual return look like this:

You can see, the small trade off between consumption now and investing for the future quickly becomes meaningful and it doesn’t come at the expense of eliminating all gratification. This can be applied to other day-to-day activities such as eating out versus cooking at home or buying a more expensive car or one that just fits your needs.

It can also be useful at different stages of life. For young working professionals, it means more money in retirement, when you don’t have income coming in from work. For retirees, it may mean more for future care costs, money to help your children (eliminating their financial stresses) or a greater ability to do charitable giving.

How will you use the increased savings during the pandemic? Assessing where current and future pain points lie can mean less stress and worry for the future. Open discussion and evaluation can provide self care and healing, leading to better lives for you and those you love.

The views expressed are those of the author and not necessarily those of RGF Integrated Wealth Management, which makes no representations as to their completeness or accuracy.

Estate Planning Misconceptions

In this 5-minute webinar, we explore an important but often misunderstood area of financial planning.

Learn More