Recently, we have been surrounded with news about a slowing economy and central banks raising interest rates in an attempt to lower inflation. This level of uncertainty in the economy has sparked a lot of volatility in capital markets.

The famous writer of The Intelligent Investor, Benjamin Graham once said, “The investor's chief problem, even his worst enemy, is likely to be himself”.

As the saying goes, when there is bad news, it is human nature to want to act and get out of the market. The good news is that there might be a solution that could help.

For investors with long time horizons, it usually pays to stay invested, and – to keep on investing. Avoid the temptation of timing the market and “buying the dip” which usually results in buying high and selling low.

It may be difficult to see the bigger picture amid all the uncertainty but consider the strategy of investing through negative volatile periods with Dollar Cost Averaging (DCA).

Dollar Cost Averaging (DCA) is the act of investing a fixed amount on a regular basis such as bi-weekly, monthly, or quarterly. This discipline capitalizes on building wealth over a long period while ignoring short term negative volatility.

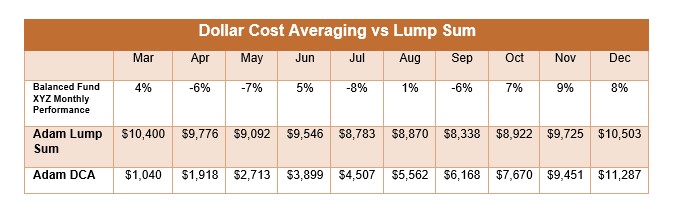

Let us look at Adam who started investing during a volatile 10-month period, comparing a lump sum investment of $10,000 at the beginning of the period vs. regular monthly contributions of $1,000 for the period.

If Adam invested in March and stayed invested, he would be rewarded with a 5.03% return on investment by the end of the period. By Dollar Cost Averaging, he would be better rewarded with a 11.29% return on investment highlighting the advantage over the lump sum strategy.

Historically, on average, bull markets are long and bear markets are short by duration. Dollar Cost Averaging works as you are reducing exposure to the possible downside of the market (short term volatility) but because your money continues to be invested further, it increases the exposure overtime and participates in better market performance

If you are already contributing to your long-term savings plans on a regular basis, give yourself a pat on the back for being disciplined.

Volatile markets can persist longer than expected and staying rational is harder in practice. There are many factors at play such as risk tolerance, asset allocation and performance expectations.

Please consult with your RGF Financial Advisor for more information.

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More