First Home Savings Accounts (FHSA)

Oct 20, 2022

Are you saving to buy your first home? Are you a parent looking to help your children with a down-payment on their first home? If so, here are 5 things you should know about the new Tax-Free First Home Savings Account (FHSA) announced in the 2022 Federal Budget.

1.) Who can open a FHSA?

To open a FHSA, an individual must be:

A.) A resident of Canada

B.) 18 to 71 years of age

C.) Have not owned a home in the year the account is opened or the preceding 4 calendar years.

2.) What is the benefit of opening a FHSA?

Contributions to the FHSA are tax-deductible, reducing taxable income, and withdrawal(s) towards purchasing a home as a first-time home buyer are not taxed and do not need to be repaid.

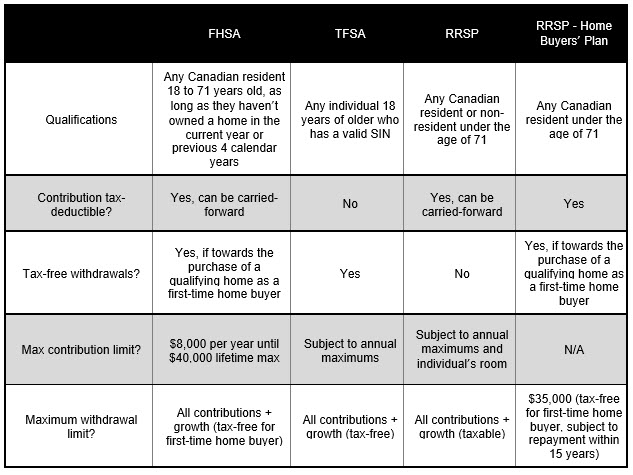

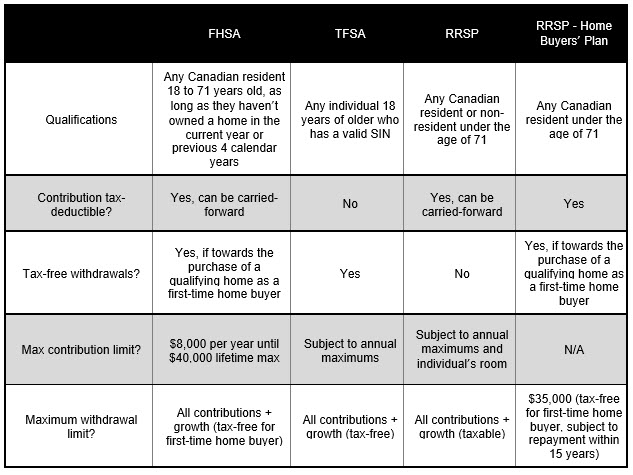

3.) How does the FHSA compare to other ways of saving for a home like a TFSA or RRSP?

Here is a helpful summary comparing the various options:

4.) How much can you contribute to a FHSA?

There is an annual contribution limit of $8,000, with a lifetime maximum of $40,000. An individual is allowed to carry-forward unused portions of their annual contribution limit up to a maximum of $8,000. Eg. Contributing $5,000 to a FHSA in 2023, would mean an allowable contribution of $11,000 in 2024 ($8,000 for 2024 + $3,000 from 2023). Carry-forward only begins to accumulate once a FHSA is opened.

5.) When can I open a FHSA and when must the plan be closed?

Most institutions plan to make this available sometime in 2023.

A FHSA must be closed at the earlier of:

• The year the account holder turns 71 or

• 15 years after the account is opened

Talk to your RGF Integrated Wealth Management advisor if opening a FHSA fits into your overall financial plan.

1.) Who can open a FHSA?

To open a FHSA, an individual must be:

A.) A resident of Canada

B.) 18 to 71 years of age

C.) Have not owned a home in the year the account is opened or the preceding 4 calendar years.

2.) What is the benefit of opening a FHSA?

Contributions to the FHSA are tax-deductible, reducing taxable income, and withdrawal(s) towards purchasing a home as a first-time home buyer are not taxed and do not need to be repaid.

3.) How does the FHSA compare to other ways of saving for a home like a TFSA or RRSP?

Here is a helpful summary comparing the various options:

4.) How much can you contribute to a FHSA?

There is an annual contribution limit of $8,000, with a lifetime maximum of $40,000. An individual is allowed to carry-forward unused portions of their annual contribution limit up to a maximum of $8,000. Eg. Contributing $5,000 to a FHSA in 2023, would mean an allowable contribution of $11,000 in 2024 ($8,000 for 2024 + $3,000 from 2023). Carry-forward only begins to accumulate once a FHSA is opened.

5.) When can I open a FHSA and when must the plan be closed?

Most institutions plan to make this available sometime in 2023.

A FHSA must be closed at the earlier of:

• The year the account holder turns 71 or

• 15 years after the account is opened

Talk to your RGF Integrated Wealth Management advisor if opening a FHSA fits into your overall financial plan.

You might also be interested in...

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.