The Power of Compounding

Apr 15, 2021

According to Albert Einstein, “compound interest is the most powerful force in the universe.” Imagine a snowball rolling down a snow-covered mountain getting larger and larger with each rotation – that is an example of compound growth in action.

Compounding also plays a critical role in the financial world. At a base level, compound growth (or compound interest) is easy to understand: if you buy an investment for $100 and it returns 10% each year, your growth will be $10 in the first year ($100 times 10%) and $11 in the next year ($110 times 10%). Benjamin Franklin summarized this process well by explaining that “money makes money. And the money that money makes, makes money."

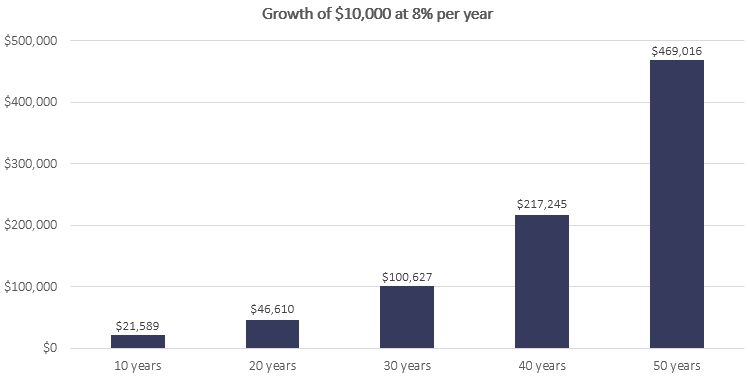

In the short term, this does not have a significant impact. However, over the long term, the benefits of compounding can be monumental. Consider an initial investment of $10,000 that grows at a rate of 8% per year – the chart below shows the ending value over different time periods:

While the growth on the left side of the chart is respectable, the effect of compounding becomes most noticeable after 20 years. Doubling one’s investment horizon from 20 years to 40 years results in nearly 5 times the amount of growth!

However, it can be difficult for most of us to save or invest early in our lives. Buying a home (especially in the lower mainland) and starting a family are both expensive tasks. Furthermore, employment income is often low early in one’s career. The unfortunate reality is that it can be challenging to save when the benefits of compounding are the greatest.

There are two ways to help overcome this challenge:

1. Start early, even if the amount is small. Investing $100 a month at age 25 can be as powerful as investing $1,000 a month at age 55.

2. If you are a parent or grandparent and have sufficient financial resources, consider helping your children or grandchildren access the power of compounding by helping them invest. Your Financial Advisor would be happy to discuss this topic further with you.

Warren Buffett is a legendary investor and one of the five richest people in the world. He began investing at age 11 and will turn 91 later this year. An underappreciated reason for his success has been the length of time he has allowed compounding to work its magic – almost 80 years!

Mr. Buffett might have described this phenomenon best when he explained that "the nature of compound interest is it behaves like a snowball of sticky snow. And the trick is to have a very long hill, which means either starting very young or living very old."

The views expressed are those of the author and not necessarily those of RGF Integrated Wealth Management, which makes no representations as to their completeness or accuracy.

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More