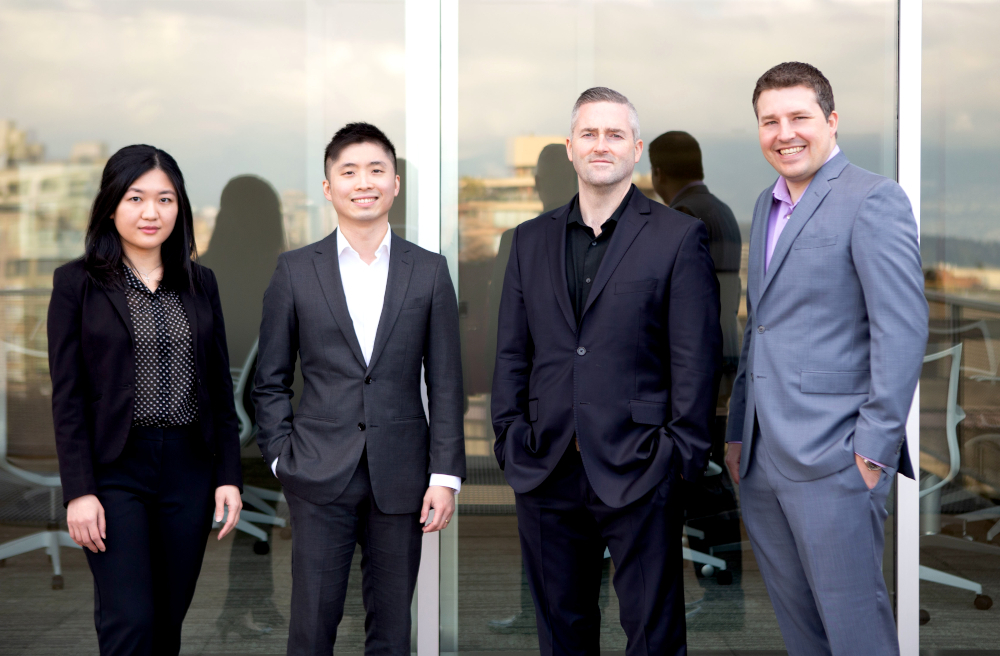

I’d like to introduce you to two new Financial Advisors on our team. Daniel Sitar and Anthony Ma have both been with RGF Integrated Wealth Management for many years.

Daniel Sitar is a Portfolio Manager and specializes in designing high-quality investment portfolios. Anthony Ma is a Chartered Professional Accountant (CPA) and specializes in tax and estate planning. They will be working with me as I continue to help you achieve your long-term financial goals; my involvement will remain the same. Laurencia will continue to be your day-to-day contact

.jpg?sfvrsn=271ebf48_2)