The Tale of Two Inflations

Apr 28, 2022

Over the past few months, there has been a growing rumble of conversation about inflation. Most people know what inflation is but understanding the root cause of inflation can be something different. So, I’ll start with the definition of inflation.

Inflation – in economics, inflation is the general rise in the price level of a good (or basket of goods) over a period of time. When the general price level rises, each unit of currency buys fewer goods and services.

The general consensus among central bankers and economists is that a low and steady inflation rate is good. This allows an economy to continue growing at a steady pace, and it reduces the severity of any negative economic events … a.k.a. recessions. The trick is being able to “control” inflation and know what is causing the inflation.

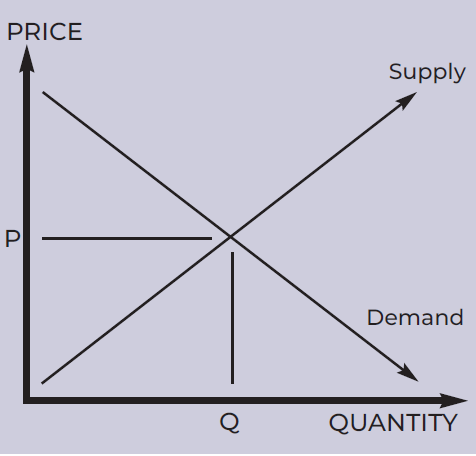

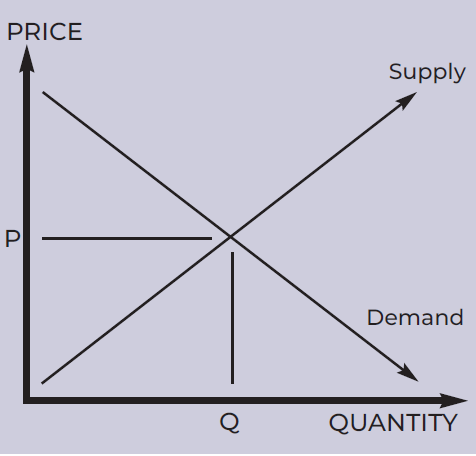

From a high level, price increases happen when there is an increased demand for a good, and/or a decrease in supply for a good. Please see the following graph to see how this works.

For a given amount of supply and demand, P represents the price that the market will pay. If demand increases, but the supply of the good remains the same, prices go up. And if demand remains the same, but the supply of the good goes down, prices also go up. Thus, the tale of the two inflations. However, in the mind of economists and monetary policymakers, one brings more concern than the other.

Historically, when we have heard inflation is “on the rise,” almost always it was driven by increased demand. The public has more money to spend, and is able to spend more for a particular good. As mentioned earlier, a little inflation is good, but too much inflation can become a large problem.

Last summer, the cause for inflation could be squarely blamed on lack of supply. There was no shortage of supply-chain problems around the world. Goods were produced, but stuck waiting for distribution to the consumer. This began when port activities were shut down in Asia for a few weeks at the beginning of the pandemic. Two years later we still have yet to catch up. In some cases, it has become worse. Regardless of what it is, we know that when the supply of a good is reduced, prices go up because there is not enough to go around.

However, the concern over supply- driven inflation is much less. The feeling is, it’s just a matter of time for supply to increase/catch up, and prices will subsequently come down as the “normal” equilibrium finds itself again.

For this reason, we heard relatively little about inflation concerns until late last fall. Both the Bank of Canada and the US Federal Reserve had little to say and pledged to stay the course. Then in early December signals began to suggest demand-driven inflation was a growing problem.

As I have shared with many clients over the last year, the North American economy has shown a strong resiliency throughout the pandemic. For the most part, a large majority of the economy kept going about its business as per “normal,” it was only the delivery of business that changed. As a result, most employees in Canada saw no change to their wages, and in many cases, saw material raises. With these raises, many Canadians were able to spend more. Initially, their spending offset those who had lost jobs or had a material reduction in wages. Then last fall, it was realized that our un-employment rate had dropped significantly. Together, this changed the stance of economists as they realized a material amount of the inflation was driven by demand. Thus, what was not a concern a few months ago, now raised flags.

When a government or central bank sees inflation growing to a concerning level, they have two major tools they can put to use. First, they can reduce the money supply – simplistically, reducing funding programs, making these programs unavailable for corporate/economic expansion, which reduces the demand for goods used in expansion, and reduces inflation. This typically happens in the background and is not noticeable to most households. And second, they can increase interest rates, which means borrowed money will cost more, thus there is less money to spend on goods, which reduces demand, which reduces inflation.

At this point the federal government and the Bank of Canada have begun using both tools, but it will take a while before we see the effects of these tools. Typically, it can take six to nine months to see the inflation needle move in the right direction, and up to two years before one might feel that “inflation is under control.” This is not to say we should expect a spike in interest rates, but we are likely to see interest rate increases on a regular basis for a couple of years.

Then there are the supply chain issues. If these are resolved and improved in the months/years to come, this will also lower the inflation issue. They may even reduce the Bank of Canada’s need to raise interest rates further than one may think. There are lot of factors for this to come true, but it does have a material level of probability.

On the whole, I see the current situation as a good news story. Our national economy has weathered one of the largest global issues in the last century and done it well. If the Bank of Canada feels comfortable enough to raise interest rates, that means they believe the Canadian economy is in a good place to absorb these increases. Sure, no one likes to pay more interest, but there’s an equilibrium to be struck, and right now we need to make some adjustments. Adjustments we should be able to make without a material effect on our quality of life.

I can proudly say that at times like these my university minor in economics has been really helpful! I hope I have explained this well. If it raises further thoughts or questions, please feel free to reach out to your RGF advisor. ■

Inflation – in economics, inflation is the general rise in the price level of a good (or basket of goods) over a period of time. When the general price level rises, each unit of currency buys fewer goods and services.

The general consensus among central bankers and economists is that a low and steady inflation rate is good. This allows an economy to continue growing at a steady pace, and it reduces the severity of any negative economic events … a.k.a. recessions. The trick is being able to “control” inflation and know what is causing the inflation.

From a high level, price increases happen when there is an increased demand for a good, and/or a decrease in supply for a good. Please see the following graph to see how this works.

For a given amount of supply and demand, P represents the price that the market will pay. If demand increases, but the supply of the good remains the same, prices go up. And if demand remains the same, but the supply of the good goes down, prices also go up. Thus, the tale of the two inflations. However, in the mind of economists and monetary policymakers, one brings more concern than the other.

Historically, when we have heard inflation is “on the rise,” almost always it was driven by increased demand. The public has more money to spend, and is able to spend more for a particular good. As mentioned earlier, a little inflation is good, but too much inflation can become a large problem.

Last summer, the cause for inflation could be squarely blamed on lack of supply. There was no shortage of supply-chain problems around the world. Goods were produced, but stuck waiting for distribution to the consumer. This began when port activities were shut down in Asia for a few weeks at the beginning of the pandemic. Two years later we still have yet to catch up. In some cases, it has become worse. Regardless of what it is, we know that when the supply of a good is reduced, prices go up because there is not enough to go around.

However, the concern over supply- driven inflation is much less. The feeling is, it’s just a matter of time for supply to increase/catch up, and prices will subsequently come down as the “normal” equilibrium finds itself again.

For this reason, we heard relatively little about inflation concerns until late last fall. Both the Bank of Canada and the US Federal Reserve had little to say and pledged to stay the course. Then in early December signals began to suggest demand-driven inflation was a growing problem.

As I have shared with many clients over the last year, the North American economy has shown a strong resiliency throughout the pandemic. For the most part, a large majority of the economy kept going about its business as per “normal,” it was only the delivery of business that changed. As a result, most employees in Canada saw no change to their wages, and in many cases, saw material raises. With these raises, many Canadians were able to spend more. Initially, their spending offset those who had lost jobs or had a material reduction in wages. Then last fall, it was realized that our un-employment rate had dropped significantly. Together, this changed the stance of economists as they realized a material amount of the inflation was driven by demand. Thus, what was not a concern a few months ago, now raised flags.

When a government or central bank sees inflation growing to a concerning level, they have two major tools they can put to use. First, they can reduce the money supply – simplistically, reducing funding programs, making these programs unavailable for corporate/economic expansion, which reduces the demand for goods used in expansion, and reduces inflation. This typically happens in the background and is not noticeable to most households. And second, they can increase interest rates, which means borrowed money will cost more, thus there is less money to spend on goods, which reduces demand, which reduces inflation.

At this point the federal government and the Bank of Canada have begun using both tools, but it will take a while before we see the effects of these tools. Typically, it can take six to nine months to see the inflation needle move in the right direction, and up to two years before one might feel that “inflation is under control.” This is not to say we should expect a spike in interest rates, but we are likely to see interest rate increases on a regular basis for a couple of years.

Then there are the supply chain issues. If these are resolved and improved in the months/years to come, this will also lower the inflation issue. They may even reduce the Bank of Canada’s need to raise interest rates further than one may think. There are lot of factors for this to come true, but it does have a material level of probability.

On the whole, I see the current situation as a good news story. Our national economy has weathered one of the largest global issues in the last century and done it well. If the Bank of Canada feels comfortable enough to raise interest rates, that means they believe the Canadian economy is in a good place to absorb these increases. Sure, no one likes to pay more interest, but there’s an equilibrium to be struck, and right now we need to make some adjustments. Adjustments we should be able to make without a material effect on our quality of life.

I can proudly say that at times like these my university minor in economics has been really helpful! I hope I have explained this well. If it raises further thoughts or questions, please feel free to reach out to your RGF advisor. ■

You might also be interested in...

Business Owners

The most overlooked area of financial planning for business owners and incorporated professionals is the lack of integration between corporate and personal assets. When the majority of your assets are in your corporation you need very specific, specialized and personalized financial advice.

Learn More

Popular Categories

Search Insights

Book a meeting

Schedule a meeting with an RGF Advisor.